By American Institute of Architects

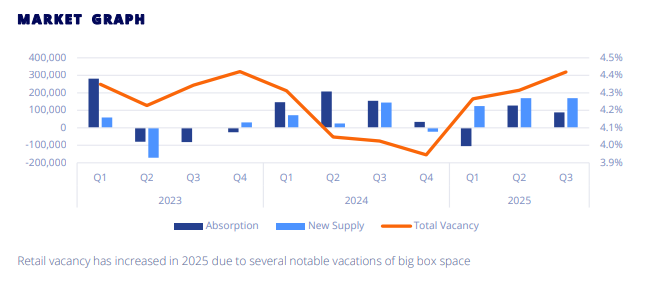

It has now been nearly two years since (architectural) firms saw sustained growth. However, clients are still expressing interest in new projects, as inquiries into work have continued to increase during that period. However, those inquiries remain challenging to convert to actual new projects in the pipeline, as the value of newly signed design contracts declined for the fifth consecutive month in August.

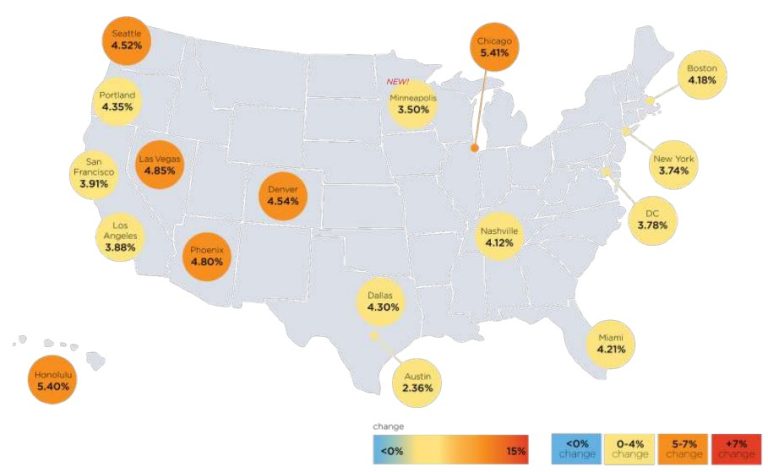

Business conditions softened in all regions of the country in August, with firms located in the West reporting the softest conditions for the second consecutive month. Billings were flat at firms located in the Northeast for the previous two months but dipped back into negative territory again this month. Firms of all specializations also saw declining billings in August, with conditions remaining particularly soft at firms with a multifamily residential specialization.

Firms Uncertain About Improvements by End-of-Year

We wanted to see if architecture firm leaders think that business conditions at their firm have reached a turning point where they should start to improve over the coming months.

When asked how they think revenue at their firm for the second half of 2024 will compare to the first half, responding firm leaders were nearly equally split: 34% think that revenue will increase, 33% think that it will decrease, and 33% think that it will be about flat.

Of those who think revenue will be up in the second half of the year, 7% think it will be up by 10% or more, while 27% think it will be up by 5% to 9%. Of those who think revenue will be down in the second half of the year, 13% think it will be down by 10% or more, while 20% think it will be down by 5% to 9%.

Large firms with annual revenue of $5M or more (42%), firms with an institutional specialization (39%), and firms located in the Midwest (39%) were most likely to expect billings to increase. In comparison, small firms with annual revenue of less than $250K (50%), firms located in the West (37%), and firms with a multifamily residential specialization (37%) were most likely to expect billings to decrease.

At firms expecting an increase in their revenue in the second half of the year, 35% indicated that funds for public projects that have already been allocated, so the projects are expected to proceed is a major factor behind the anticipated revenue increase, followed by backlogs at a comfortable level (rated as a major factor by 35% of firms) and projects that have been delayed or stalled that will be restarting (rated as a major factor by 32% of firms).

Just more than half of firms (51%) indicated that a slowing construction market taking pressure off of construction labor and materials prices is not expected to be a factor in the revenue increase, while 60% said that their firm is more fully staffed and able to increase billings is not a factor.

At firms expecting a decrease in their revenue in the second half of the year, more than two-thirds of firms indicated that current projects winding down, and fewer new ones on the horizon, is a major factor in that anticipated decrease, while 52% said that uncertain economic conditions that are discouraging potential clients is a major factor, and 50% cited declining backlogs as a major factor.

Finally, when asked about their degree of confidence that their firms will see improved business conditions over the next 12–18 months, three-quarters of firms were at least somewhat confident. (Source)