The number of multifamily developments in the Reno-Sparks area has seen a decline despite low vacancy rates and increasing rental prices.

Currently, there are 6,274 apartment projects planned within the Reno-Sparks area. Five years ago, there were 9,279 planned projects. Nearly half of the apartment projects are currently under construction. All the projects considered in this report have a minimum of 80 units.

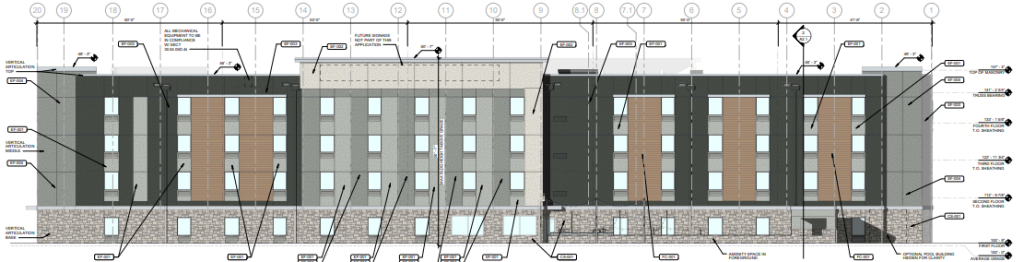

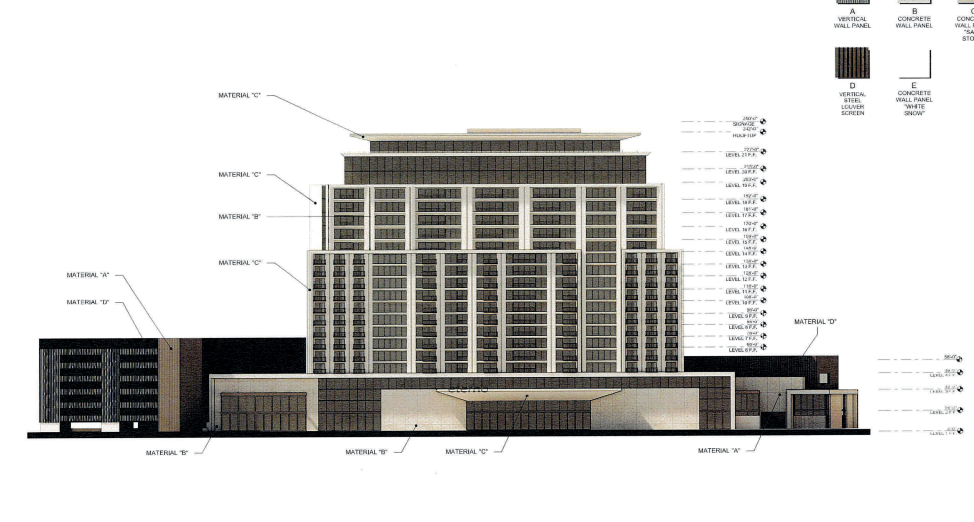

Reports show there are currently 3,124 multifamily units under construction in the Reno-Sparks area. These apartments are:

- Overlook at Keystone Canyon – 342 units;

- The Kallan – 242 units;

- Stone Village Apartments – 320 units;

- Lemmon Landing – 342 units;

- Northtowne Apartments – 120 units;

- Homecoming at Kiley Ranch – 306 units;

- Seasons at Stonebrook – 396 units;

- Elysium – 270 units;

- The Halcyon – 330 units;

- Ballpark Apartments – 368 units, and

- The Oslo – 88 units.

There are also 3,150 units in the planning phase in the Reno-Sparks area. These are:

- 5th & Vine Apartments – 302 units;

- Mountain Ridge – 200 units;

- Viewpoint Apartments – 432 units;

- Spectrum-Dandini Development – 420 units;

- The Standard – 447 units;

- Kiley Ranch Apartments – 450 units;

- Gateway at Galena – 361 units;

- Center Street Apartments – 154 units;

- 550 North Virginia – 261 units, and

- Riverside Drive Apartments – 123 units.

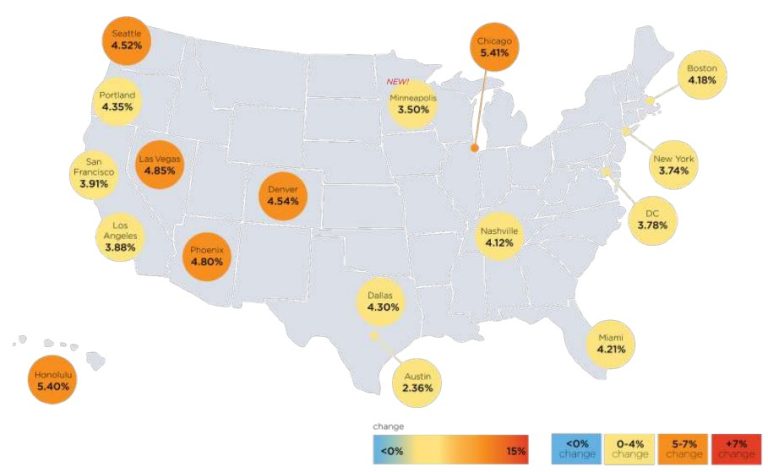

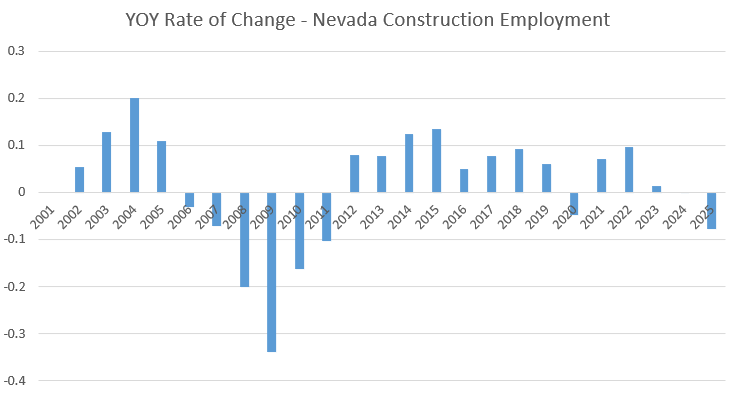

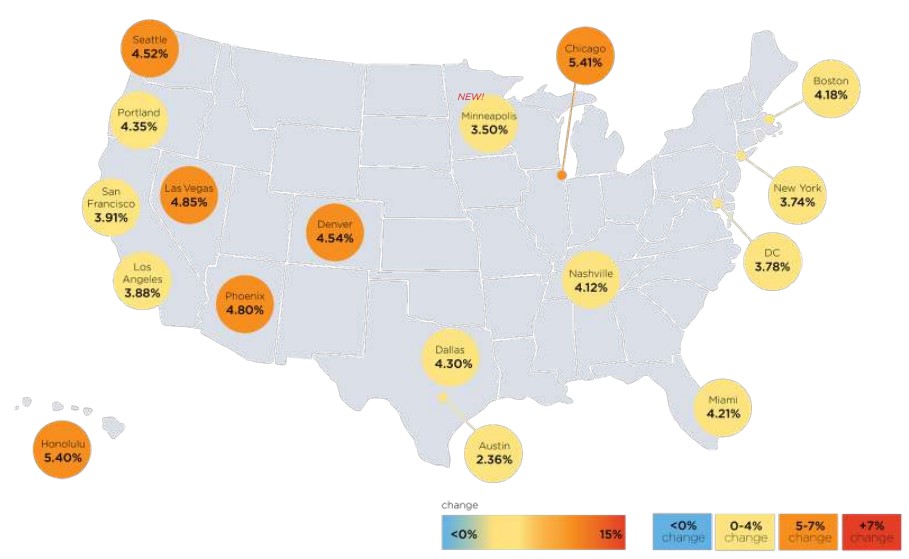

Apartment absorption is reportedly slowing down, and concessions are rising. The Nevada State Apartment Association reported the average rent in Q3 2024 in the Reno-Sparks area was $1,605. The NVSAA stated the demand is primarily based on high-end inventory, and predicted the trend will grow this year and continue to the next.

Rent in the Reno-Sparks area for apartments featuring a minimum of 80 units is the second highest it has ever been, according to data collected by Johnson Perkins Griffin. In Q3 2024, rental prices for these large apartments increased from $1,660 to $1,668. The highest recorded prices were in Q2 of 2022, where the area saw an average price of $1,680.

ALN Apartment Data recorded an average effective rent of $1,622 by the end of October 2024. Notably, ALN Apartment Data included apartments with less than 80 units. The lower price still reflects a 2.5% increase compared to the prior year. The average effective rent for affordable housing apartments is $1,173.

Vacancies saw a slight QoQ increase in seven of the 11 submarkets tracked by Johnson Perkins Griffin. All apartment types saw an increase in vacancies, but townhomes reportedly saw an increase in occupancy. The Q3 2024 vacancy rate for large apartments was 2.76%, while the vacancy rate in Q2 2024 was 2.54%.

One major factor in the increase in vacancy rates was the delivery of new multifamily projects. YoY vacancy rates have decreased, with ALN reporting a vacancy rate of 11.8%, which is a 2.1% decrease. This includes apartments both large and small. Notably, CoStar reported a vacancy rate of 9%.

ALN also reported apartment owners are offering more concessions. By the end of October, it was noted that concession offers increased to 27%, which is an approximately 31% YoY increase. Larger apartments saw a concession rate of 33%, which reflects an increase of 28.3% QoQ.

The NVSAA claimed the increase in concessions was a result of fewer construction starts, which have declined to their lowest rate since 2015. The NVSAA also noted rents have increased by 2% YoY, which causes a negative rent growth in real dollars due to high inflation rates. (Source)