Credit: Crexi

The multifamily market across the United States seems to be one of the strongest heading into 2025 and is expected to remain one of the most active sectors with new investments.

Colliers recently released an investment outlook that cited multifamily as a strong sector due to its already high demand and the entrance of Gen Z into the workforce. High home prices were also cited as one of the driving factors propelling multifamily developments.

Markets with housing shortages are expected to see significant gains, followed by a resurgence in rents. New multifamily construction is expected to slow in the latter-half of 2025, as negative rent growth impacts areas with new multifamily supply.

The report also noted difficulties, particularly those related to operational expenses. Rising insurance costs have become an issue for multifamily owners. Premiums have caused several deals to be repriced or canceled altogether.

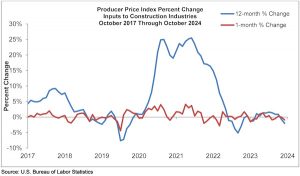

Owners are also dealing with skyrocketing prices for labor, materials and utilities. These combined challenges impact profitability and make it difficult for owners and developers to create new projects.

Interest rates are also to make a significant impact in shaping the market. If rates decrease, more capital would be freed for investment. If rates increase, activity may be reduced. Despite this, Colliers is confident the multifamily market will remain strong and continue to attract investors.(Source)