The cost of construction materials has increased due to the anticipation of effects from tariffs.

An Associated Builders and Contractors analysis of the U.S. Bureau of Labor Statistics’ Producer Price Index demonstrated a 0.6% increase of input prices in February.

Overall, this is simply a 0.3% input price increase year-over-year. The underlying factors, however, illuminate other issues. Iron and steel saw 3.9% increases; softwood lumber rose 2.8% and steel mill products rose 2.7%.

ABC Chief Economist Anirban Basu said the increases are a result of the tariffs giving domestic producers increased pricing power. He also pointed out nonresidential input prices are down YoY, but he expects that will change soon. ABC’s most recent Construction Confidence Index predicts a 23% decline in profitability over the next half-year.

Blanket tariffs were applied on March 2 for goods shipped from Mexico and China. China is currently facing a 20% tariff on all goods. Other products compliant with the United States-Mexico-Canada Agreement have had tariffs delayed until April 2. A 25% tariff on all steel and aluminum imports, regardless of origin, took effect in March.

Since the Trump Administration enacted its tariffs, China has responded with retaliatory tariffs on U.S. farm products. The European Union is also weighing potential tariffs to be implemented against the U.S. in April.

Skanska USA estimated a 494KSF medical facility that previously cost $375M would now cost an additional $17.4M. A representative of the company stated construction materials account for approximately 45% of project cost. Another representative said 27% of steel used in the U.S. is imported, as is approximately half of aluminum used in the U.S.

Tariffs could impact things such as steel, plumbing materials, elevators, HVAC and electrical products. Cost increases are still looming, even if firms try to domestically source materials. Domestic producers will raise prices because of increased demand.

Uncertainty surrounding tariffs may also cause more damage than the tariffs themselves. Estimates predict wood and structured steel as the materials with the highest cost increase. Wood is expected to increase by 25% to 30%, while steel is to see a 20% to 25% increase. HVAC equipment is expected to increase by 10% to 15%, while plumbing materials are expected to rise by 8% to 10%.

Skanska expects the playing field to drastically change in the coming months. The company also advised all A/E/C parties to work together and promote transparency and flexibility. The company also recommended keeping a tariff impact separate from cost escalation.

Impact on Housing Market

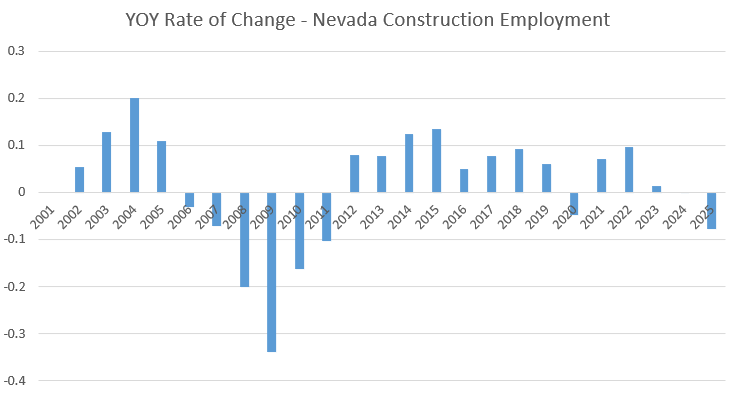

Despite demand heavily outweighing supply in the housing market, homebuilders are getting ready to pull back on production, due, in part, to tariffs.

Data from the U.S. Census Bureau indicated residential construction permits decreased 6.8% YoY in February. Permitting generally correlates to building demand more so than starts. Multifamily permits decreased the most, as Realtor.com reported the sector saw a 4.3% decrease in January and a 15.7% decrease in February. Single-family remains comparatively healthy, only seeing a 0.2% monthly decrease and 3.4% YoY decrease.

Increased construction costs are expected to filter down onto the consumer. Homebuilders have also been focusing on smaller homes to develop more affordable units.

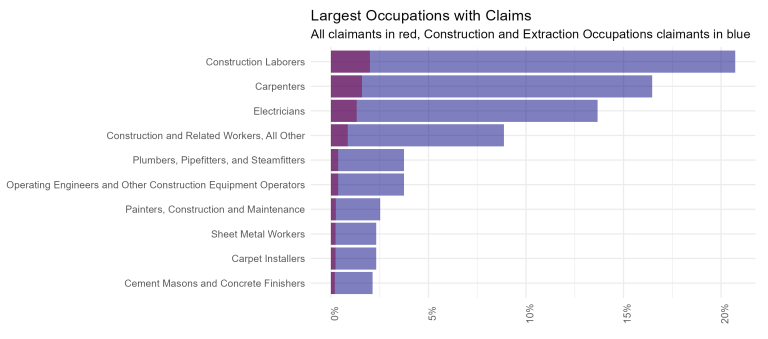

The labor market is also becoming increasingly strained due to the administration’s immigration policy. Currently, roughly a third of the construction workforce is comprised of immigrants. (Source)