BEX Founder and President Rebekah Morris recently spoke at her first event in Nevada since the launch of NVBEX.

BEX was originally founded and actively operates in Phoenix, Ariz. The event was held by the American Society of Civil Engineers Younger Members Forum, which features engineers aged 35 and younger.

Morris began her presentation with an overview of the different topics at play in her analysis of the Nevada market. The presentation topics were:

- Macroeconomic indicators;

- Federal policies;

- State, regional and local issues;

- Economic development, and

- Market sector specific stories, projects and constraints.

The market sectors ranged from public to private development. Morris launched NVBEX in November of 2024 and compiled this list from months of extensively researching the market and years of experience in the AEC industry.

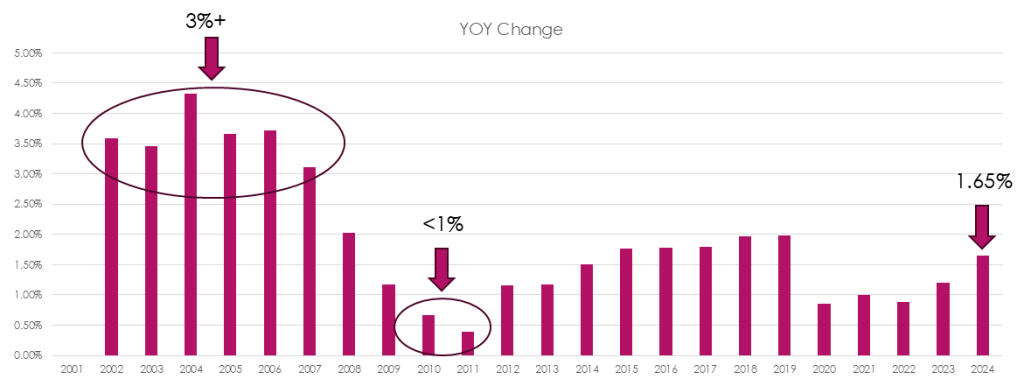

- Statewide Population

Nevada was experiencing a high population growth rate from 2010/2011, when the recession halted growth across the nation. From 2001-2007, the Silver State had previously experienced a YoY population growth rate of more than 3%. Nevada’s population growth recovered from the recession swiftly in comparison to other states.

Nevada was also hit particularly hard by the pandemic, as hospitality is the primary driving force in the state’s economy. The state has steadily recovered but still feels the pandemic aftereffects.

- Statewide Employment Metrics

Employment in the Silver State eclipsed its pre-recession peak. In the early 2000s, particularly from 2003-2007, overall employment fluctuated heavily. Since the pandemic, employment has been steadily gaining traction and hasn’t seen large sways.

- Construction Employment

Despite general employment having surpassed its pre-recession peak, Nevada’s construction industry has yet to meet these numbers. However, construction is steadily rising. Current employment numbers in the Silver State clock approximately 128,800. Pre-recession numbers peaked at around 150,000.

- Inflation

Inflation has seen a Producer Price Index increase of 29.2% since 2015. This is due to a variety of factors and has been exacerbated by the supply chain issues connected to the pandemic. Overall costs are estimated to have doubled; however, different industries and market sectors vary significantly in real effects, making it difficult to levy an entire umbrella number on inflation’s effect on the construction industry.

- Federal Immigration Policies

While many believe stricter immigration policies primarily affect worksite and in the field labor, a plethora of design workers and architecture/engineering students are foreign-born. The design pipeline is fed by universities, which have a significant population of non-U.S. born students.

- Federal Funding

Funding at the federal level impacts a variety of construction projects. Many federally funded projects begin with grants for planning and study efforts, which can take place years before a project breaks ground. Some of these project types are:

- Federal Direct Construction – Military Bases, Ports of Entry, etc.;

- Transportation;

- Transit;

- Water Conservation;

- Wind Energy;

- Solar;

- Manufacturing – Clean Energy, Electric Vehicles, CHIPS Act, and

- HUD Financing for Housing Developments.

A local example of this is Maryland Parkway BRT Project, which received $150M in federal funding.

- State, Regional and Local Legislation

The Gas Tax or Fuel Revenue Indexing, also known as FRI 2.0, was originally approved in 2016, with 60% of the voters approving the tax. The tax ensures gas taxes are on par with inflation to maintain and improve road conditions throughout the state.

After a 2023 legislative action to extend the tax was vetoed by Governor Joe Lombardo, the tax again turns to voters for approval.

- LANDS Act

Approximately 3.43M acres of land in Clark County is federally owned. The land is mostly administered by the Bureau of Land Management.

The Accelerating Appraisals and Conservation Efforts Act, alongside the Southern Nevada Public Land Management Act allows the BLM to sell public lands and directly apply proceeds to conservation projects. The laws also provide the ability for land to be set aside for affordable housing developments for up to 10 years.

Another piece of legislation, the Southern Nevada Economic Development and Conservation Act, is being reintroduced to the legislature this session. If passed, the law could set aside more than two million acres of land for conservation and affordable housing efforts.

- Economic Development Priorities

On a broad scale, three of the main economic development priorities are attracting healthcare workers, creating non-tourism/high-wage jobs and maintaining water conservation efforts while expanding the economy.

More specifically, the healthcare expansion will consist of providing more and easier access to licensing for healthcare professionals, while also aiming to provide more medical offices and hospitals.

Diversifying the economy away from gaming and tourism destinations will focus on a variety of things. One of the large diversification efforts is using Vegas’ strong entertainment potential and bringing in film studios and sports teams. Las Vegas is also seeing a surge of non-gaming hotels.

- K-12 Education

Rural counties without large populations in Nevada are especially susceptible to a lack of funding for new resources and maintenance due to a low volume of tax revenues being funneled into the school systems. An example of this is the $65M Owyhee Combined School, which had to strip back its plans, as it did not receive a single bid in its first cycle.

Clark County School District can use bond funding, as voters approved it in 2015; however, many projects were delayed due to REV 6 in June 2024.

CCSD should release its two-year SOQ for design services in the coming months.

- Higher Education

Nevada is not seeing much volume in higher education construction. There are a few proposed projects, such as the College of Southern Nevada’s northwest campus.

The University of Nevada, Las Vegas recently sold the Sam Boyd Stadium to Clark County, which may be converted to public parks.

- Public Spaces

There are a handful of large public spaces projects currently being planned. One such project is the $100M Clark County Fire Training Facility. The privately funded Las Vegas Museum of Art is also in the works.

- Transportation, Transit & Parks

These projects are heavily reliant on funding. The top three funding mechanisms for these projects are sales tax, comprising 29.4% of funding; grants, making up 18.1% of funding; and bond proceeds, which total 17.7% of funding.

Large projects include Brightline West, the Boring Company and a variety of NDOT and local municipality roadway projects.

- Aviation

One of the largest aviation projects is the Southern Nevada Supplemental Airport, which could come online as early as 2038. Current proposals anticipate the supplemental airport to have two runways, a terminal building and a potential rail line to Las Vegas.

- Utilities

Solar and wind projects may be at risk of having funding stripped on the federal level. Water and wastewater projects have been somewhat absent from BEX’s initial market research.

There still are large projects planned, such as the $576M North Valmy Methane Plant in Humboldt County.

- Housing

Housing is one of the largest market sectors in the state. If the LANDS Act passes, more land will become available to develop housing projects. One of the challenges of multifamily, and particularly affordable housing projects, development is consistent, persistent and growing NIMBY pushback.

- Record Affordable Housing Project

Despite frequent NIMBY pushback to these types of projects, the largest affordable housing undertaking in state history, the $450M Desert Pines Redevelopment, is in the works. The project is to be developed on a former golf course.

Demand remains high for multifamily and affordable housing developments, resulting in optimism that these large-scale housing efforts will continue to develop.

- Industrial & Data Centers

Reno is attracting a swath of high-value data centers and battery manufacturing projects. While data centers have a large economic benefit on a macro-scale, concerns surrounding high usage of resources like water and power are growing. While data centers create high-wage and high-value jobs, the number of permanent jobs created is typically low.

In southern Nevada, the City of North Las Vegas has been attracting a variety of warehouse projects.

- Healthcare

Healthcare is one of the primary fields in the state being pushed by economic developers. Nevada has a notoriously difficult process for licensing healthcare professionals that come from out of state. Its low facility and staff count has led to several Nevada residents seeking healthcare services across state borders.

Nevada is making progress in developing new facilities and talent. Intermountain Children’s Hospital, designed by Gensler and Shepley Bullfinch, is currently in the process of selecting its general contractor. Another large project is the VA Hospital at UNR.

- Office/Retail

While there aren’t many pure office projects available, there is an increasingly common occurrence of offices becoming a part of large master plans. A prime example of this is the $380M Hylo Park located in North Las Vegas.

- Hospitality and Sports

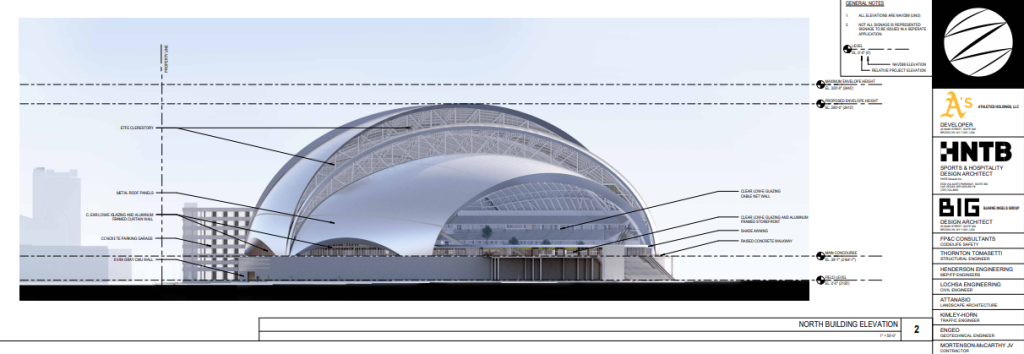

This is the primary driving force in Nevada’s private real estate development. There is a plethora of large-scale projects in this sector including the:

- A’s Stadium;

- Bally’s Development;

- Hard Rock Hotel;

- Inspirada Station Casino & Resort;

- KDH Hotel, and

- Majestic Hotel.

- Existing Spaces Must Continually Invest

Tourism-attracting developments act organically in the sense that they must be fed with redevelopments and renovations to keep customers coming back. Every five-to-seven years, hotels typically refresh guest spaces with new carpets, paint, wall coverings and furniture. Around the 10-12-year mark is when bigger renovations and redevelopments are in order.

Amenities must also see continual reinvestment to continue to elevate guest experiences.

- Sports & Movie Studio Projects are Coin Tosses

With multiple proposed sports and movie projects, the market can only handle so much. If Las Vegas is to receive an NBA expansion team, only one of the two proposed arenas would be needed to host the team.

Movie studios suffer a similar problem, where the development is key to tax-cutting incentives that have a maximum cap on how much relief it can provide for studio developments and productions.

- Rapid Changes in Large Projects

Warner Bros. is no longer working with Birtcher Development on studio plans and has now partnered with Sony. Oak View Group is no longer seeking land near Brightline for its potential basketball stadium.

These large-scale projects often have parties and details altered as time moves forward, leading to initial proposals resulting in different projects.

Note from the Editor: See this link for the latest development on this issue.

- Future Predictions

Job Order Contracting is likely to continue to become more widely used on public projects. Sports and non-gaming tourism projects will continue to grow and expand, diversifying Las Vegas’ economy.

A focus on economic development will not only benefit tourists but also provide key benefits to residents and workers in the AEC industry.