The Nevada Assembly advanced Assembly Bill 238 to the Senate during its Friday, May 30 meeting on a 22-20 vote.

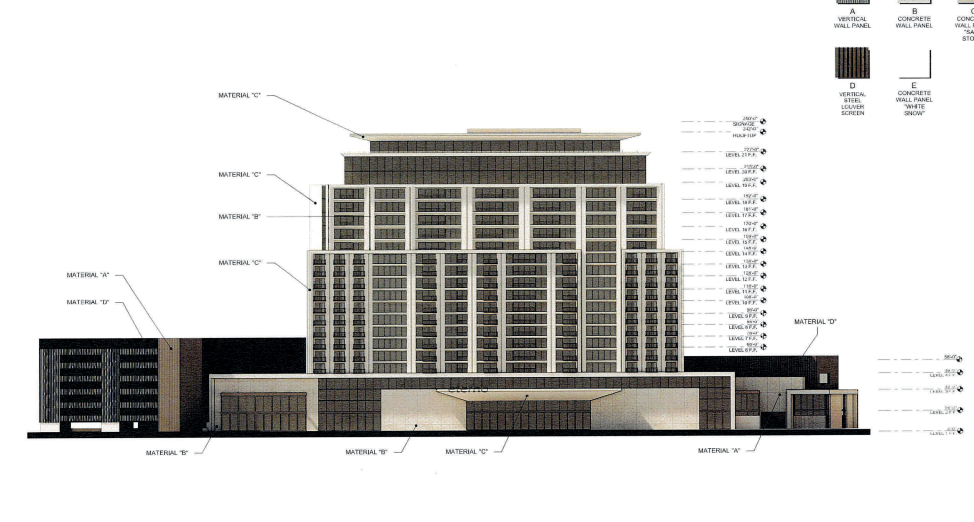

The bill is a crucial part of the proposed Summerlin Studios, a joint effort between Sony Pictures Entertainment, Warner Bros. Discovery and Howard Hughes Corp. Summerlin Studios is to be comprised of 10 buildings, including a 500KSF studio/production facility; 100KSF of retail, restaurant and office space; an emergency room, and a satellite office for Clark County. Gensler is the architect attached to the project. (NVBEX; Feb. 15)

Supporters of the project say it carries a $3B economic impact upon its completion. The proposed legislation would set aside $95M in annual film tax credits for 15 years beginning in 2028. Approval comes shortly after a report was released detailing uncertainties surrounding its economic impact. (NVBEX; May 31)

Amendments were added on May 24 that created financial safeguards and established a special assessment district to support pre-K expansion throughout Clark County.

The bill moves to the Senate with only three days left in the legislative session. If it makes it through the Senate, the bill will then go to Gov. Joe Lombardo for final approval.

Potential Merger with Senate Bill 220

AB238 has a sister bill that has been stuck in the Senate Finance Committee. Sen. Roberta Lange is proposing to merge the two bills to get both passed. This would result in a $2.2B price tag.

If the bills were to merge, this would result in two distinct studio sites that have lower individual film tax credit allocations than originally proposed. Lange claimed other lawmakers have requested a merged bill and that the State does not have enough to fund both bills individually.

Lange’s SB220 is currently backed by MBS Group. The merger details each film studio would receive $60M in annual tax credits starting in Fiscal Year 2028. This is a roughly $30M decrease from each of the original proposals.

The state would also be required to provide $25M in non-infrastructure tax credits to be used for anything but film production. This $25M would be shared between the two studios. In total, the state would be obligated for $145M every year.

Lange’s three-year ramp-up period would be included in the merger, which would provide $73M in tax credits throughout the next Fiscal Year. This would bring the grand total of tax credits to $2.2B across the next 18 years.