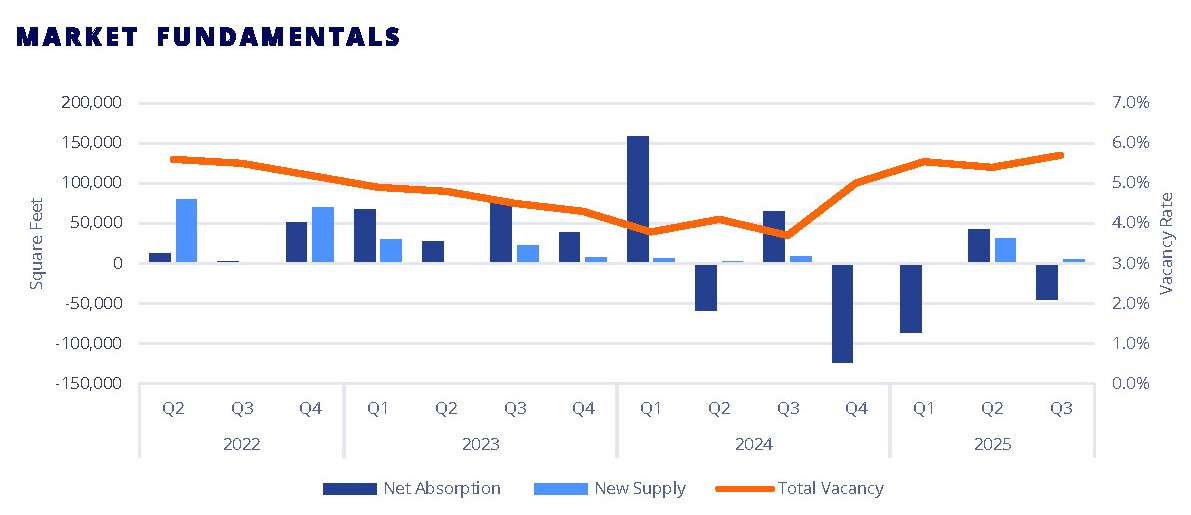

What kind of landing the current collection of economic difficulties and the processes used to try to correct them will result in appears to be largely anyone’s guess at the moment.

The Federal Reserve, economists, companies and players involved in business and the financial markets have mostly been aiming for a “soft landing,” in which inflation gradually decreases without triggering a recession or large-scale unemployment, as would happen in a “hard landing.”

There exists, however, the possibility of “no landing,” in which inflation lingers but economic growth and employment remain strong, giving the Fed no room for additional interest rate cuts.

Harvard economist Lawrence Summers recently referred to the 50 basis point September rate cut as, “…a mistake, though not one of great consequence.” He sees the cut as adding to the risks of hard landing or no landing based on the September jobs data, since nominal wage growth has remained higher than pre-pandemic levels and is not slowing down.

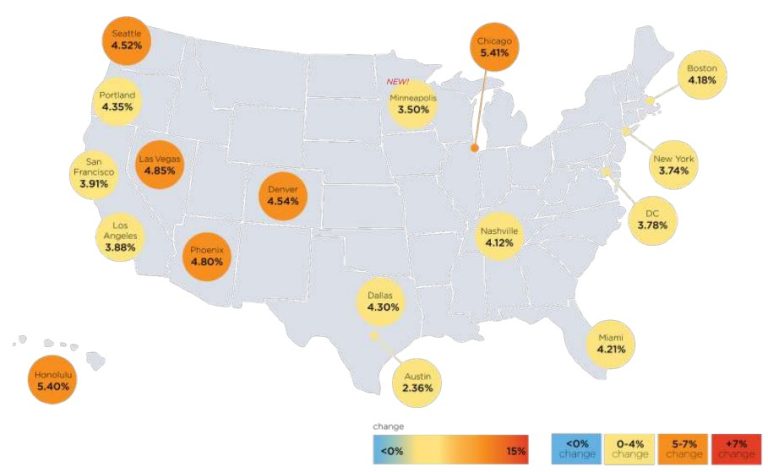

Bond traders are also looking at a no landing scenario based on the September employment data. The yield on the 10-year Treasury closed at more than 4% (4.03%) for the first time since July 31. Higher Treasury yields usually mean the financial markets expect higher interest rates.

For months, markets have been looking forward to sharp and ongoing rate cuts, lower inflation and slower growth. That expectation appears to have shifted. DWS Americas’ George Catrambone now says the Fed may halt rate cuts or, possibly, have to raise rates again. (Source)