The Las Vegas Retail market’s average asking lease rate stayed flat year-over-year, landing at $2.01/SF/month NNN.

With land costs and costs of construction still high, paired with low vacancy rates, achieved lease rates are expected to continue to rise. The Central East submarket posted an 11.7% availability rate and 11.1% vacancy rate, both nearly triple the market average of 4.7% and 4.2%, respectively.

The Central West submarket recorded the largest signed lease of the quarter, with an undisclosed tenant signing 45,551SF in Q4 2024 at Flamingo Jones Center. Meanwhile, in the Southwest Burlington signed 28,864SF at Blue Diamond Crossing, and Goodwill signed 24,864SF on Raiders Way in the Southeast.

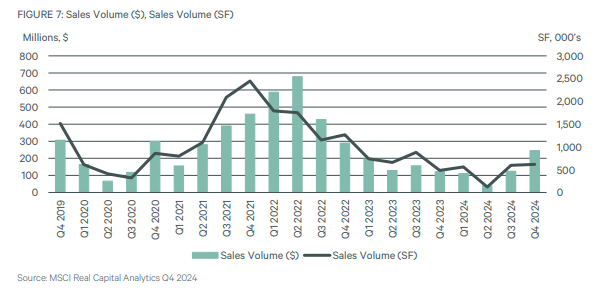

Sales Trends

In Q4 2024, the Las Vegas retail market experienced significant sales activity, with 616KSF feet sold, totaling $245,545,133. This marks a year-over-year increase of 132KSF in sales volume and a $124,157,045 rise in sales value.

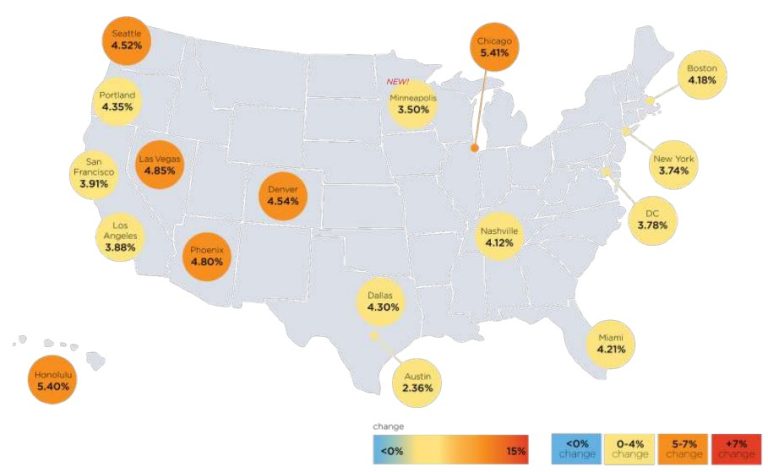

Notable transactions included the sale of Vista Commons for $56.1M and Mountains Edge Marketplace, which traded for $55.3M at a 6.8% cap rate. Additionally, the top five largest sales came from five different submarkets, highlighting the widespread investment interest across the region. Cap rates are still high but are expected to fall in the latter half of 2025 as interest rates are expected to fall. These figures underscore the strong demand and investment interest in the Las Vegas retail market.

Economic Overview

The Las Vegas economy continues to exceed expectations. Much of this is due to sturdy consumer spending and increased YoY gambling revenue. In 2024 was a great year economically. Las Vegas held Superbowl 58 at Allegiant Stadium in February 2024, and F1’s second year both brought higher than expected economic impact to the economy. With the “no tax on tips” initiative coming in 2025, it is expected to increase household revenue, further increasing consumer demand which drives the retail market.

Nationally, steady economic growth alongside Federal Reserve rate cuts would be rocket fuel for commercial real estate performance. The catch is capital markets have grown skeptical of just how low rates will go in 2025. The mix of sticky core inflation and future policy concerns are putting upward pressure on long-term rates.

Nevertheless, real estate capital markets have made good progress in recent quarters. Lending spreads are tightening, and credit issuance is up. Lending conditions are easing a bit as multifamily loan-to-values are trending slightly upward. Stronger debt markets and balanced and/or recovering space market fundamentals should translate into a noticeable uptick in investment during the next several quarters. (Source)