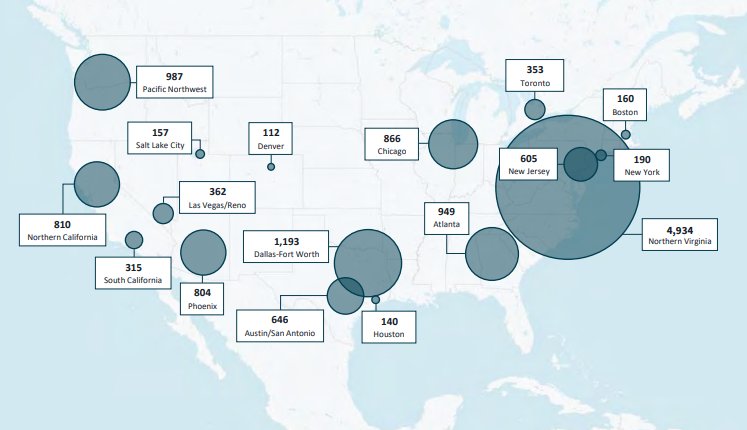

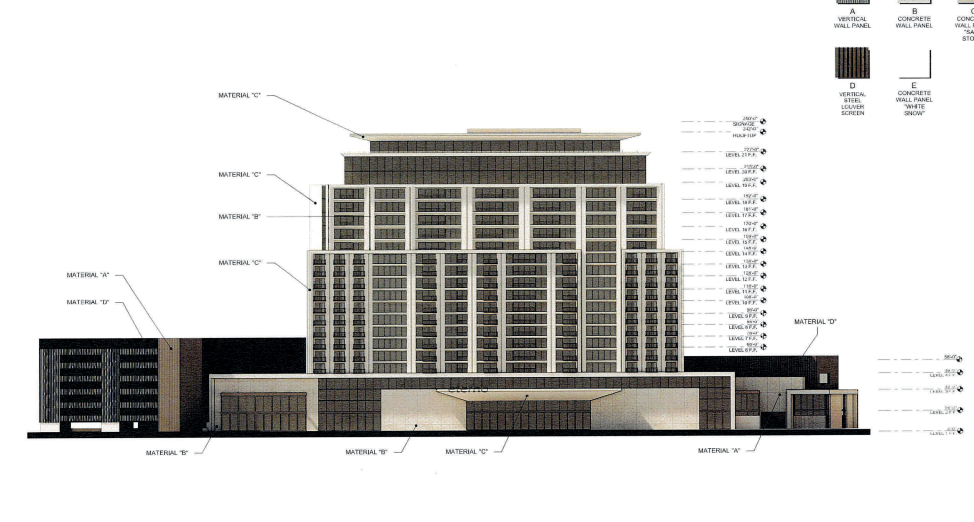

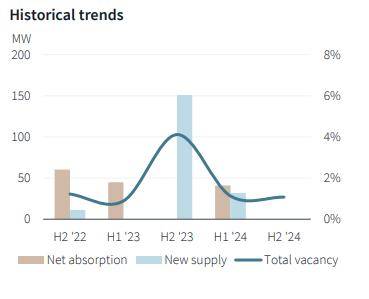

The data center market throughout Nevada is trending positively as the 2020s approach its midpoint, with 362MW in total inventory and 14MW under construction.

JLL recently released its North America Year-End 2024 Data Center Report which examined various markets on the continent in both macro and micro lenses. Nevada was featured as one of the continent’s established markets.

Market on a Micro Scale

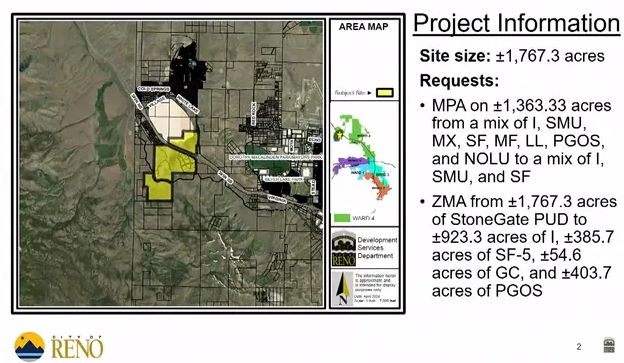

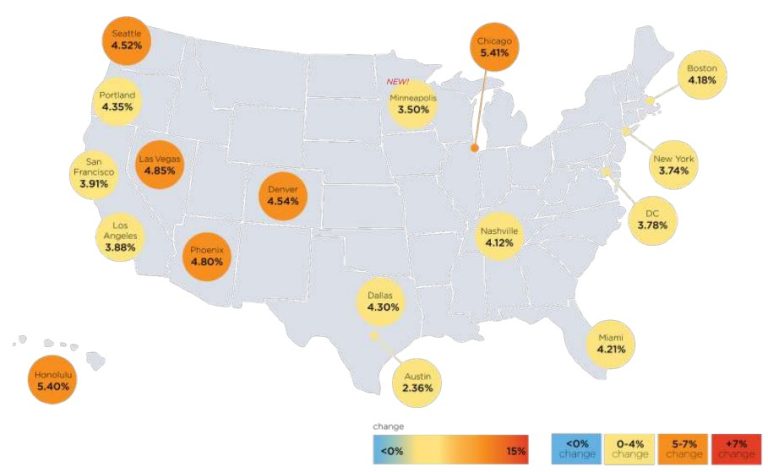

Nevada is appealing for data centers as it has favorable tax incentives and access to West Coast markets. Nevada offers abatements on sales and use tax for equipment. The Southwest region in general has substantial demand for data centers.

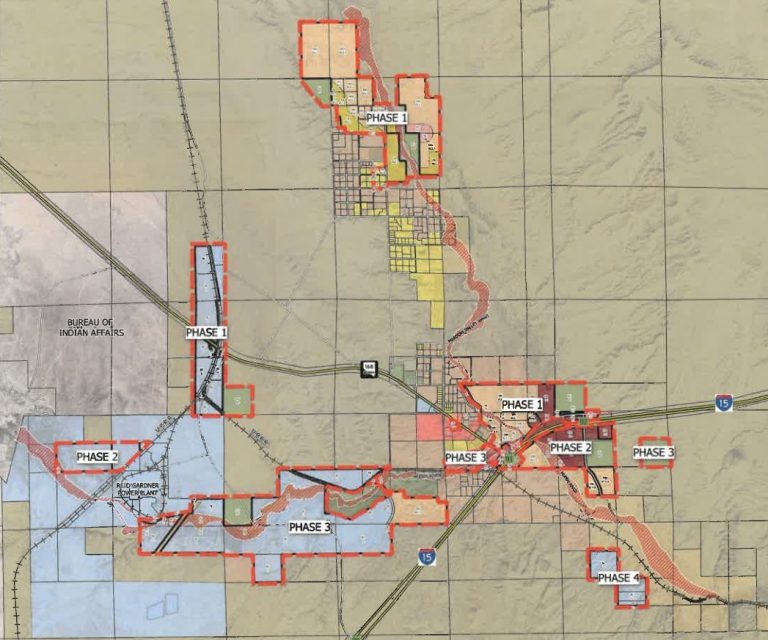

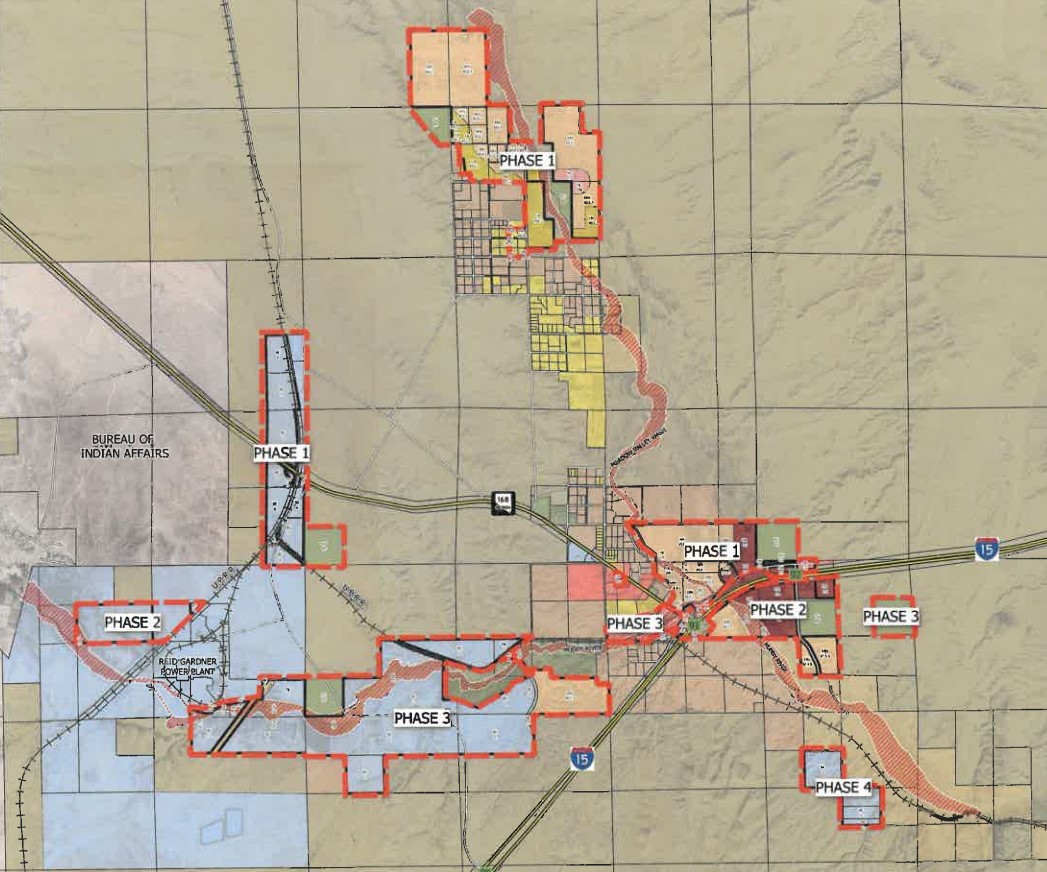

Both Las Vegas and Reno are projected to become some of the fastest growing data center hubs in the U.S. The Silver State has 3,308MW planned. Vacancies account for 1% of the existing market, which equates to 4MW. Rental rates currently sit at $145-$195kWh/month.

The markets both have limited supply but have large developments underway that will support demand. Demand is outpacing supply, which is creating upward pressure on pricing. Nevada has a strong technology infrastructure market despite its small size. The majority of the market is in Reno.

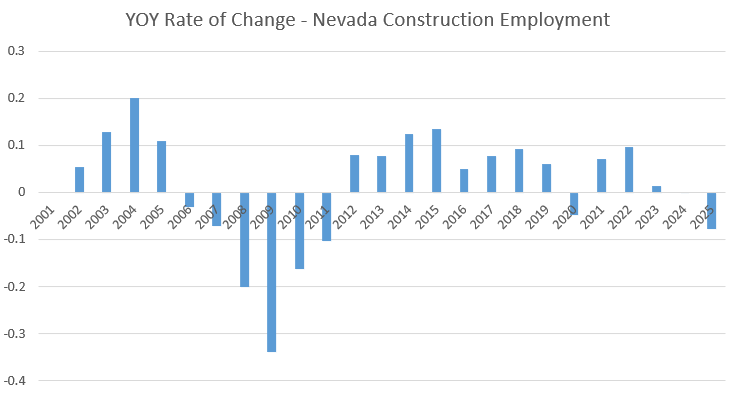

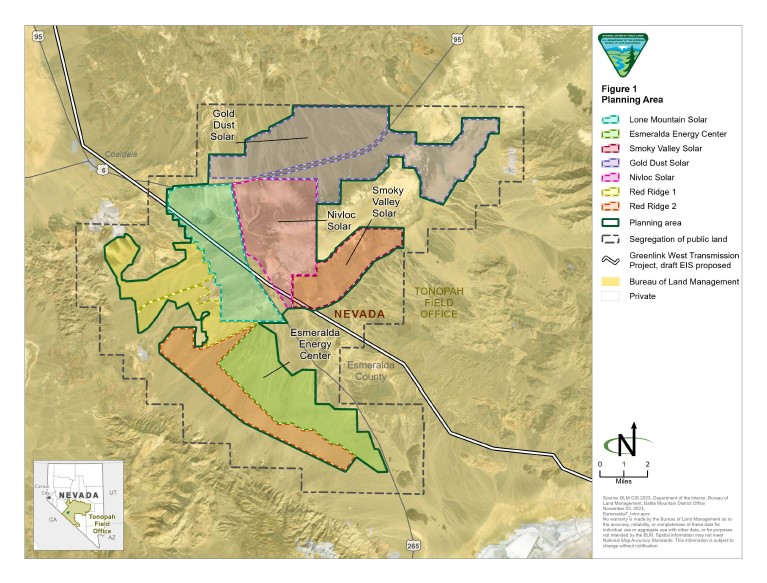

Supply constraints are expected to be resolved in a relatively short period of time as more projects come online. Power constraints are one of the state’s most prevalent issues. Despite this, estimates project power supply to nearly double in the coming 15 years to support the market. Developers are also looking into increased power infrastructure from generation projects to transmission upgrades.

Market on a Macro Scale

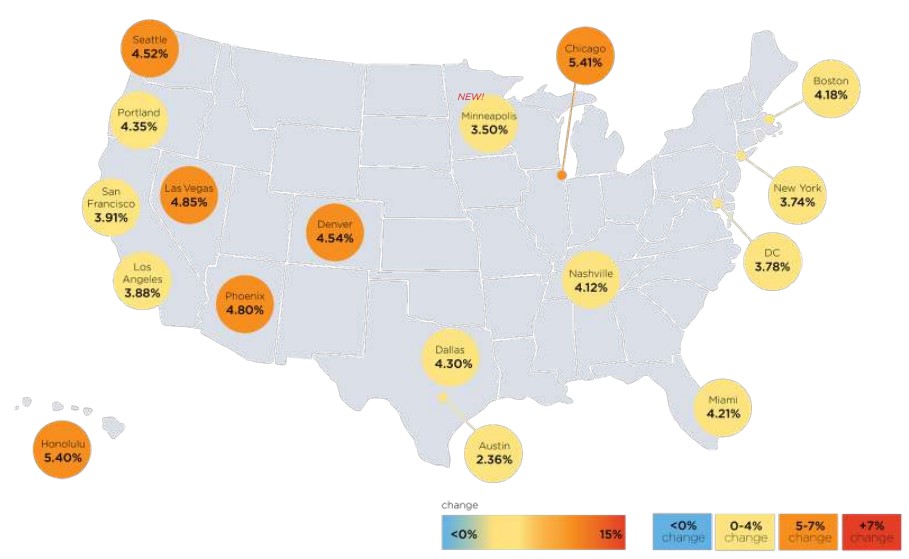

In 2024, North America saw vacancy rates decline to a record low of 2.6%. Currently, more than 6.6GW of colocation capacity is under construction. Of those under construction, 72% are preleased. The year saw rents average an 11% compound annual growth rate.

The sector remains strong due to high demand, limited supply and rapidly increasing rents. The sector also saw a diversification of lender engagement. Power supply is one of the pressing issues facing the sector. Generally, it takes four years for a grid connection to be established. Suppliers are implementing policies to qualify the increasing amount of power requests.

Due to power constraints, developers are expanding into new markets. Generally, hyperscalers are the first to move to new markets followed by colocation providers.

While supply chains are improving, there is still room to grow. As equipment manufacturing is reshored, lead times will continue to decrease. Significant improvements are expected to occur throughout 2026-2027.

North America currently has an established inventory of 13.6GW. The past year saw 2.6GW in completions, and an absorption of 4.4GW. At this time, 22.9GW are planned.

The top three markets in the continent are: Northern Virginia with 4,934GW, Dallas-Fort Worth with 1,193GW and the Pacific Northwest with 987GW.