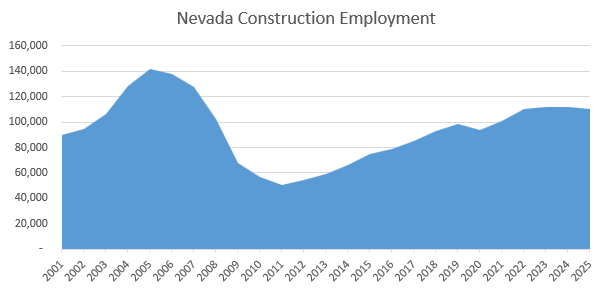

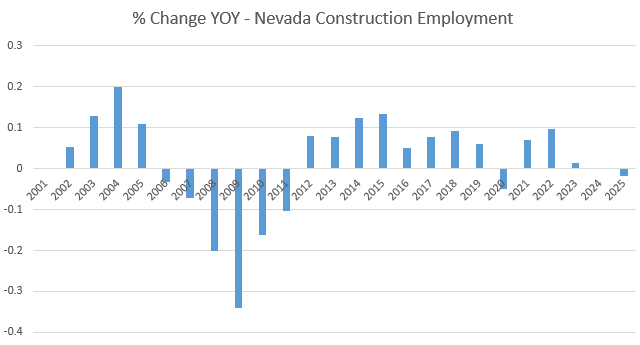

The Nevada Construction sector steadied after consecutive months of decreasing employment and gained 100 seasonally adjusted positions in March 2025.

The Silver State ended the month with 110,400 positions. The Construction sector remained relatively stagnant over the month and continues to make up 7% of Nevada’s overall private nonfarm positions. The 100-job gain reflects an increase of 0.1% month-over-month, according to nevadaworkforce.com.

In year-over-year data, the industry grew by 600 positions, or 0.5%. Notably, February data was readjusted by the Bureau of Labor Statistics to reflect total employment of 110,300 positions.

Nevada’s peak construction employment was 142,500 in 2005. Current data displays industry employment is 22.4% lower than peak pre-recession numbers.

EDITOR’S NOTE: We are including both seasonally and non-seasonally adjusted data for the Construction industry. Seasonally adjusted data continues to change after it is originally posted, so the wider array of data is intended to provide a more accurate view of the market.

Non-Seasonally Adjusted Data

Non-seasonally adjusted data lists total construction employment as 109,100 – which represents a MoM growth of 2,000 positions, or 1.9%. In YoY terms, the sector gained 1,000 positions, which accounts for a 0.9% growth.

Non-seasonally adjusted data splits Construction into two subcategories: Construction of Buildings and Specialty Trade Contractors.

Construction of Buildings grew by an estimated 100 positions in March, bringing its total to 17,700. Its MoM growth was 0.6%. After its past two consecutive months of growth, the subsector equaled out YoY. Record employment in the subsector reached 26,500 jobs.

Specialty Trade Contractors reversed the fall it had been experiencing, boasting an increase of 1,100 jobs MoM. The subsector now has 79,900 positions, which equates to a healthy monthly growth of 1.4%. In terms of YoY data, the subsector has grown by 1,000 positions, or 1.3%. Its previous employment high was 107,200, which marks a deficit of 27,300.

Seasonally Adjusted Non-Construction Fields

The closely related Manufacturing sector saw slight increases. Manufacturing consists of two subsectors: Durable Goods and Nondurable Goods. Manufacturing accounts for 67,700 jobs, which is a return to its all-time high. The sector saw a net increase of 300 positions, or 0.4%.

Durable Goods grew by 300 jobs, bringing its total to 46,100. The subsector has seen a YoY increase of 1,700 positions, or 3.8%. Its growth in March contributed to its steadily increasing record high employment figure.

Nondurable Goods, after months of steady decline, flattened out with no MoM change. This maintained the subsector’s YoY decrease of 5.3%, or 1,200 positions. Regardless, the employment count remains relatively high as it is coming down from its peak of 23,000. Current numbers reflect 21,600 employees.

The largest MoM decline was Financial Activities, with a loss of 1,000 roles. This is a substantial sector in Nevada’s economy and makes up 5.1% of statewide nonfarm employment. YoY, the sector remained relatively stagnant, experiencing a growth of 100 positions. Notably, the sector has come down from its employment high of 80,900 positions.

The sector is comprised of two subsectors: Finance and Insurance and Real Estate and Rental and Leasing. Both subsectors lost 500 jobs. This reflects a 1% decrease in Finance and Insurance, and a 1.5% decrease in Real Estate and Rental and Leasing.

Leisure and Hospitality remains Nevada’s largest sector, making up 23% of its overall nonfarm employment. The sector also experienced the highest MoM growth of any sector, adding 2,000 jobs. In total, the sector accounts for 365,300 positions.