A potential rebound of the Las Vegas metropolitan area’s economy is possible if the national economy increases its productivity in 2026.

Colliers recently released its Market Research Report for Q4 2025, which recapped the year and provided insights into local industries as well as the overall economy.

Toward the end of 2024, Southern Nevada appeared as though its economy was finally stabilizing after the thrashing of the pandemic. The ensuing year resulted in more economic uncertainty, particularly due to a slowing hospitality sector.

Hospitality Specifics

Overall, visitor volume decreased by 7.6% year-over-year, with every month posting less YoY visitation. Colliers’ report noted the last time the hospitality sector performed so poorly was due to the pandemic.

Colliers reasoned that the cause of the economic slowdown was due, in part, to slowing visitor volume (particularly from foreign visitors), a “failure to capture the young adult demographic” and the overall high prices seen in the region.

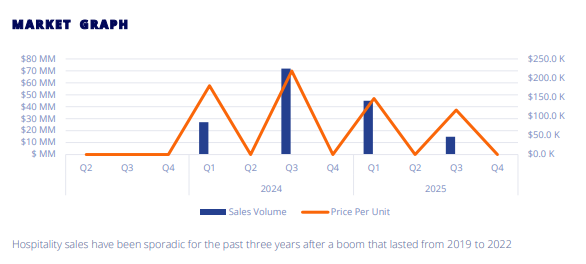

From a real estate perspective, both 2025 and 2024 had poor showings in terms of the number of hotel rooms sold. In 2025, there were only 435 rooms sold; 2024 performed slightly better with 479. For context, on average, more than 7,000 rooms were sold annually from 2015 to 2022.

Room occupancy decreased slightly YoY from 85.7% in October 2024 to 83.7% in October 2025. The steepest decline was seen in Downtown Las Vegas.

Despite visitor volume falling 7.6%, gaming revenue YTD grew 1.1% as of October 2025. The Average Daily Rate and Revenue Per Room also declined YoY.

As far as inventory goes, 2025 saw a net increase of 1,276 rooms, while 2024 saw a net decrease of 1,470 due to the closure of Tropicana Las Vegas.

Notable hospitality projects to watch in 2026 include Delta Hotels by Marriott, Courtyard by Marriott South, TownePlace Suites Southwest, Majestic Plaza and Hylo Park.

The report noted that, while unfortunate, the slowing hospitality sector and flat job growth do not present a dire situation to the overall market.

Industrial Specifics

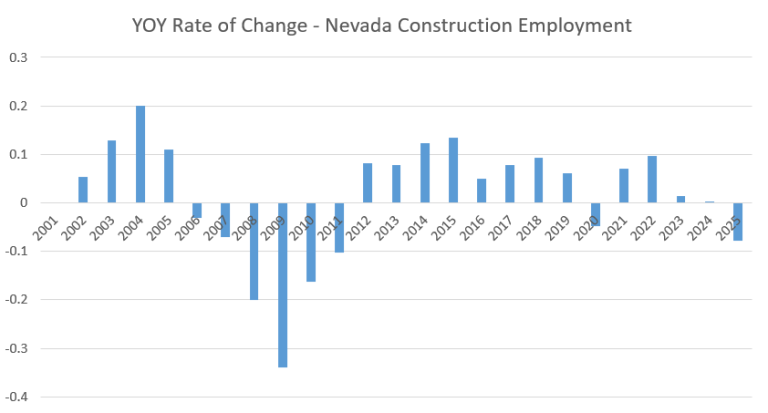

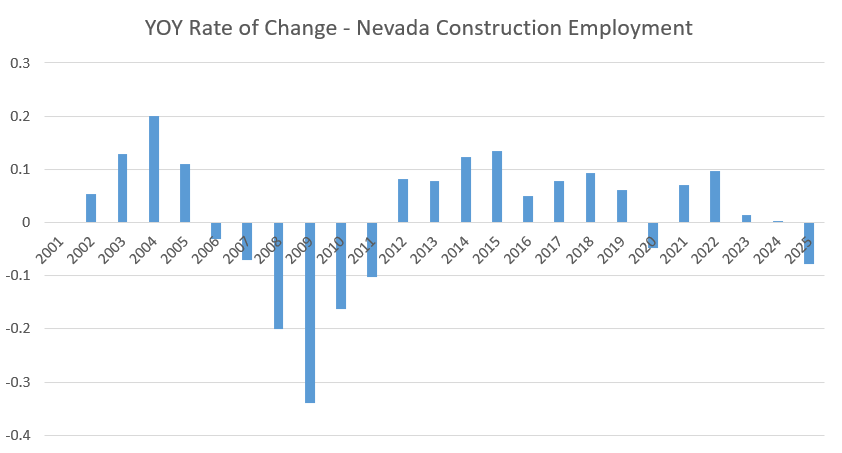

The industrial inventory in the region increased by 6.8MSF over the course of the year, reaching a grand total of more than 186MSF. This is a significant slowdown from 2024, which saw the completion of 15.9MSF. The majority of completions were seen in the warehouse/distribution subsector.

North Las Vegas experienced the largest inventory expansion throughout 2025. The next four quarters currently have 5.5MSF scheduled for completion, 66.2% of which is already pre-leased. Currently, there is 3.1MSF of industrial space under construction.

Net absorption increased for three consecutive quarters to 3.19MSF, while vacancies are now down to 9.2%. Over the course of the year, net absorption totaled 5.13MSF.

Throughout 2025, the sector experienced greater net absorption than in the prior year. Total net absorption ended the year at 5.1MSF. The majority of positive absorption was seen in warehouse/distribution, as well as light distribution. Light industrial and flex spaces each had negative net absorption.

Colliers predicts the market will recover in 2026, although there are concerns surrounding the quantity of space available for sublease and the sector-wide weak employment performance.

Office Specifics

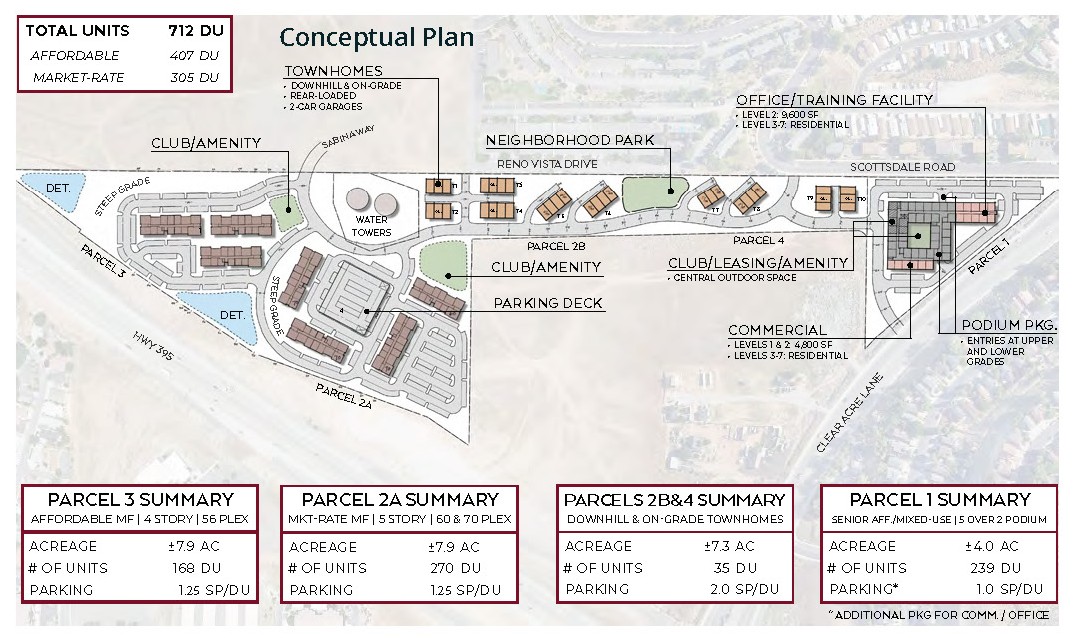

Office inventory in the region expanded by 146KSF in the final quarter of 2025. This was entirely comprised of two Class B office buildings. The region is currently home to 46.2MSF of space.

Currently, there is an additional 148KSF under construction. Within the next four quarters, 98KSF is scheduled for completion, 15.9% of which is pre-leased.

There was a vast improvement seen in net absorption across the year, which rose to 378.4KSF. The majority of absorption (280.6KSF) was seen in Q4. The sector-wide vacancy rate fell to 11.7%.

Colliers believes the Southern Nevada office market will continue to improve throughout 2026 as it did in 2025. The report noted, however, that due to the rise of artificial intelligence and other obstacles facing the market, it is unlikely that the sector will rebound to pre-pandemic levels.

Retail Specifics

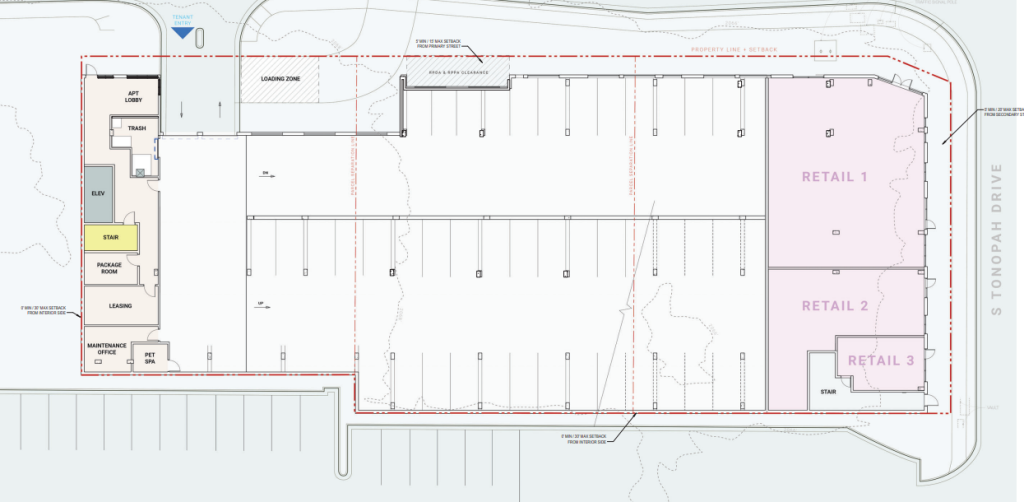

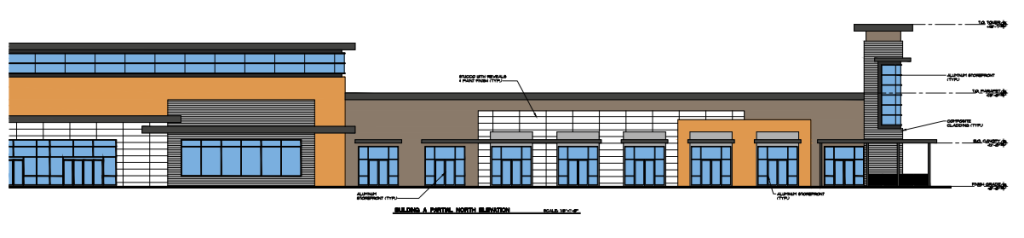

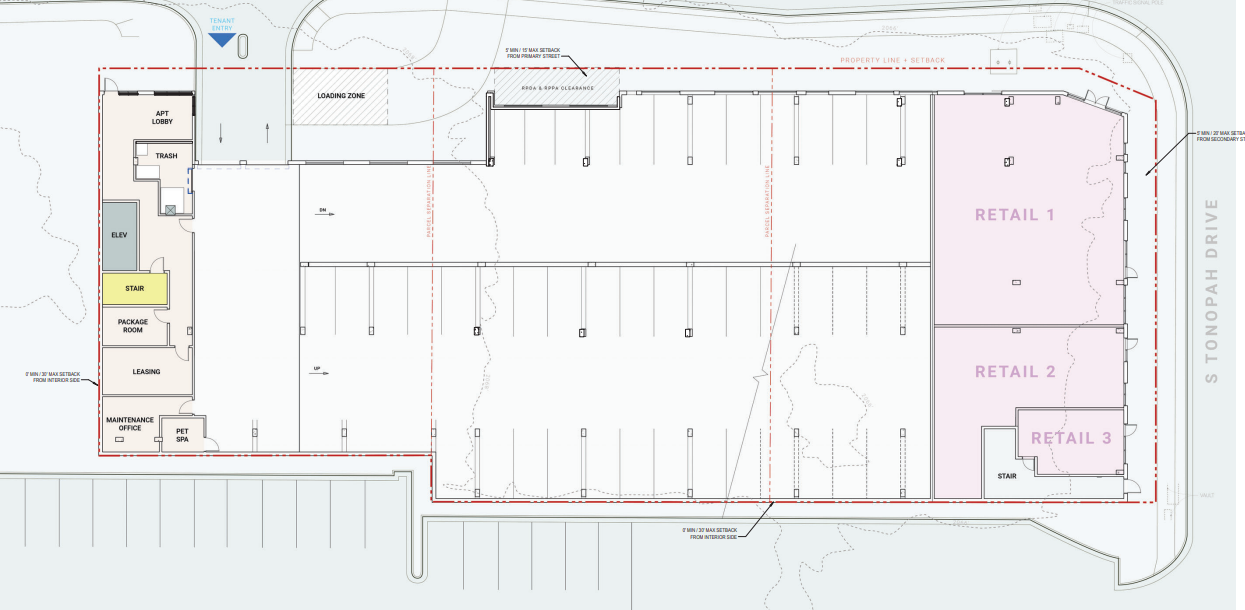

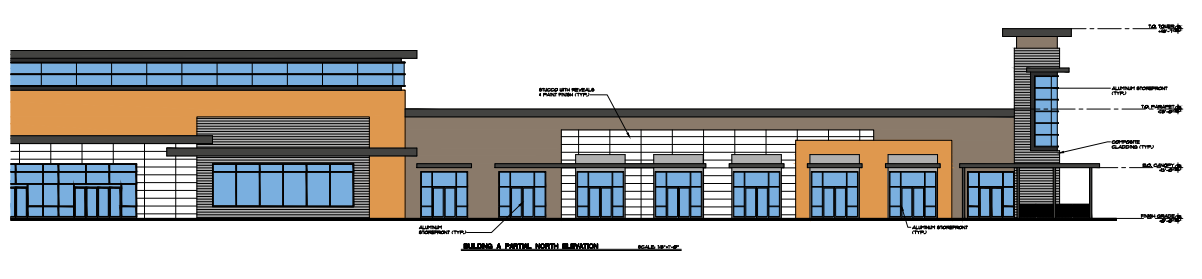

Retail inventory in Southern Nevada experienced a slight increase of 22.8KSF in Q4. Throughout the entire year, 705.7KSF was added to the inventory, bringing the market-wide stock to 70.8MSF.

Retail inventory in Southern Nevada experienced a slight increase of 22.8KSF in Q4, bringing the total inventory up to 70.8MSF. In total, 2025 saw 705.7KSF in completions.

Currently, there is 499KSF of space under construction. Throughout the next four quarters, 416.5KSF is slated for completion; 62.8% of which is pre-leased.

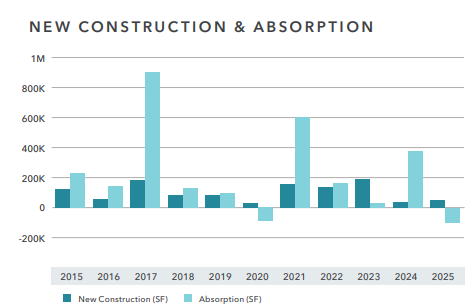

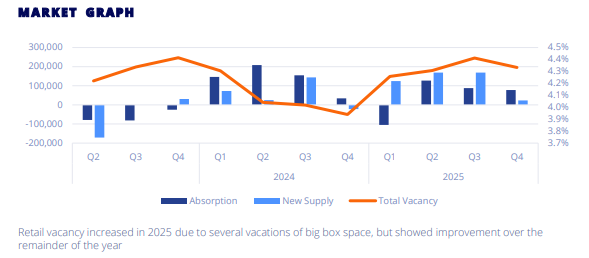

Net absorption decreased YoY, in part due to an incredibly strong performance in 2024. In 2025, net absorption was 238.2KSF, while 2024 had 543.1KSF. Q4 saw the vacancy rate drop to 4.3%.

Colliers predicts the retail market will remain relatively stable in 2026 after strong growth in 2019, 2021 and 2022. For reference, each of those three years had net absorption exceeding 1MSF. Since 2023, retail jobs have been on the decline and do not show signs of recovery.

Medical Office Specifics

Q4 did not see any medical office completions. Total inventory in Southern Nevada currently sits at 8.5MSF.

Currently, there is 89KSF of medical office space under construction. The entirety of space under construction is slated for completion in the next 12 months; all of which is pre-leased.

Although Q4 experienced positive net absorption of 24.4KSF, the overall net absorption in 2025 was negative 152.7KSF. The report indicated this is primarily due to a “major vacation of space that occurred in the early part of the year.” Vacancy rates increased to 9.4%. Notably, if the large space weren’t vacated, the rate would be 7.0%.

Colliers predicts that healthcare employment will continue to increase throughout 2026 alongside demand. The report also indicated net absorption will rebound once the 89KSF IHC Health Services Campus completes construction. To read the entire report, click here.