The retail market in Reno experienced a strong number of construction starts throughout 2025 that began to slow in the final quarter of the year.

Kidder Mathews recently released its Q4 Reno Retail report, which found the metropolitan area had an increase in vacancy and rental rates year-over-year. Additionally, the area had a lower YoY unemployment rate. The area also had a lower number of deliveries in 2025.

Vacancy rates increased from 3.5% in Q4 2024 to 4.1% in Q4 2025, which reflects a YoY change of 60 basis points. Despite the increase, vacancies experienced a slight decline quarter-over-quarter, with Q3 2025 having a rate of 4.2%.

The average asking rent/SF increased by $0.10 YoY from $1.41 to $1.51. This reflects a YoY increase of 7.08%. Average asking rents may be stabilizing, as the average asking price in Q3 was $1.50.

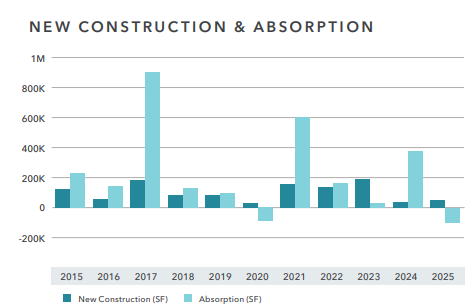

Both Q3 and Q4 2025 had 93.8KSF of retail properties under construction. While growth slowed QoQ, the sector experienced a strong boost in construction starts over the year, as Q4 2024 only had 52KSF of retail space under construction. This is a YoY change of 80.55%.

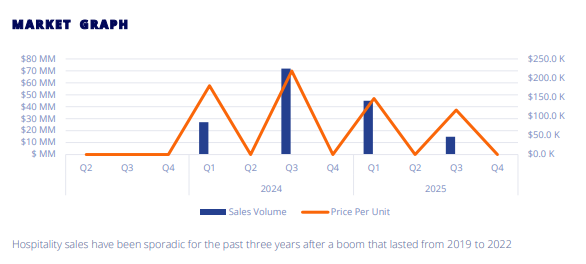

The average cap rate now sits at 6.3%. This is a fall from the previous quarter, which sat at 7.3%. YoY, however, the average cap rate has increased from 5.8%, or by 50 bps.

While there were no deliveries in Q4 2025, the entirety of the year saw 50.9KSF in deliveries. This is roughly 11KSF more than 2024, which had slightly less than 40KSF in deliveries.

Net absorption in Q4 was 39.4KSF. As a whole, 2025 had a negative 99.4KSF in retail absorption. This is a stark contrast from 2024, which absorbed 374.5KSF over the course of the year. This reflects a YoY change of -126.55%. To read the full report, click here.