Assembly Bill 238 proceeded through the Assembly Ways and Means Committee this past weekend.

AB238, the legislation that would ultimately fund the Summerlin Studios proposal, was sponsored by Daniele Monroe-Moreno and Sandra Jauregui. The two legislators added a clause that would create a special use district in the area that would use tax revenue to fund Clark County School District’s pre-K programs and the Clark County Education Association.

NVBEX previously covered proposed film tax credits and the projects it would bring. (NVBEX; Jan. 14; Feb. 15; Feb. 28)

The bill is far from guaranteed, however, as five assembly members voted against its passage. Other members voted to move it out of the committee but said their vote could be swayed on the Assembly floor.

Hesitant assembly members referenced future related costs and the lack of funding from the federal government. Amendments were added to require the Hollywood studios to invest $4.5B in production spending over the next 15 years.

Amendments were also introduced to create penalties for the studios if they fail to meet base production requirements. If the studios fail to meet these standards, they may be obligated to repay portions of, or even all, of the film tax credits earned. Studios are also required to report to the State.

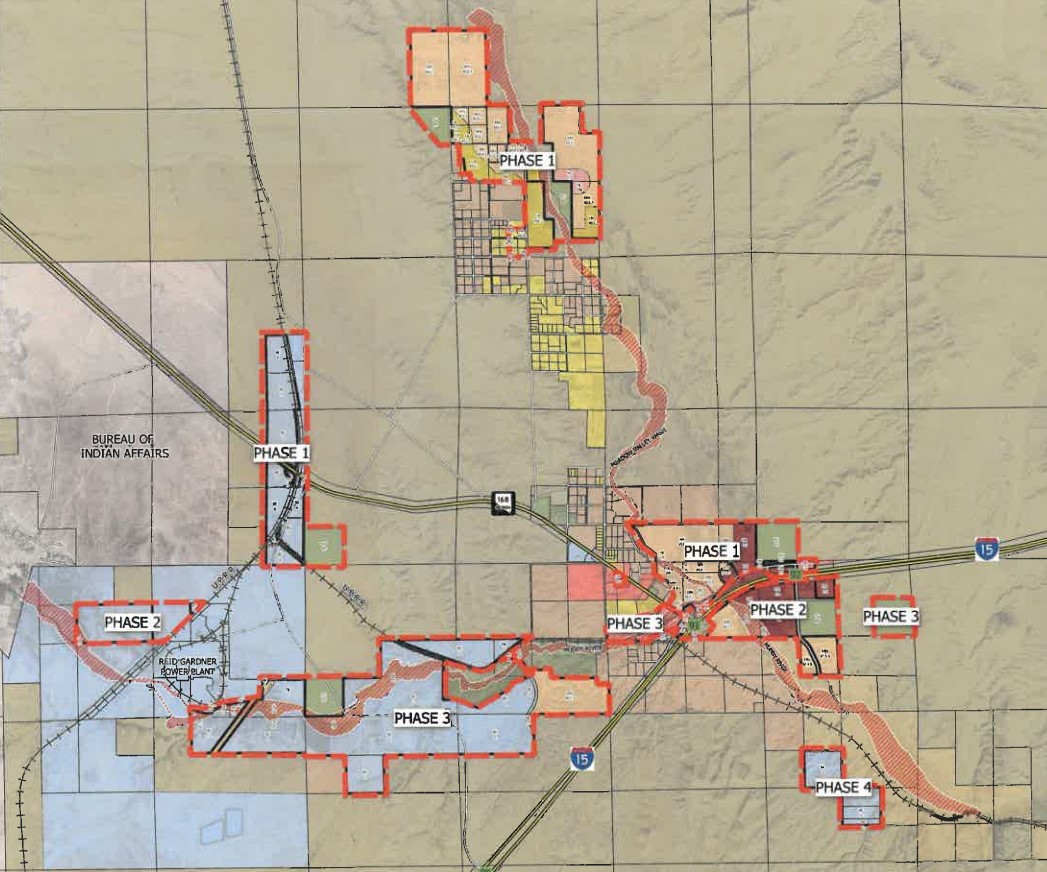

The Governor’s Office of Economic Development can record a lien for undeveloped land if development milestones are not reached in two years. Amendments were added that require four capital investment milestones that will result in a minimum of $400M by June 30, 2028, and $1.8B by Dec. 31, 2038.

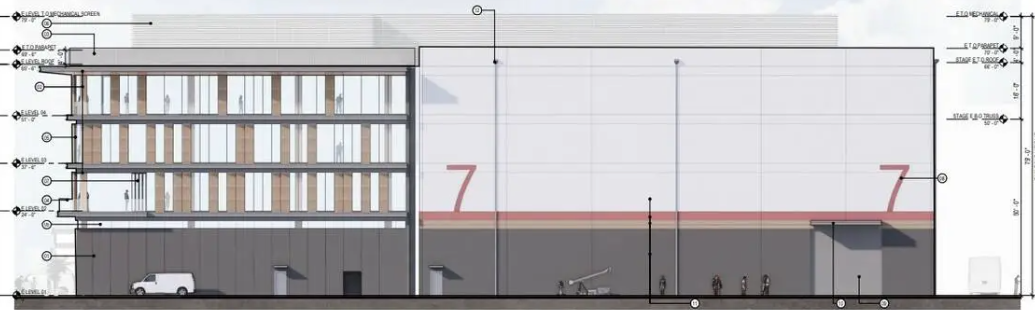

AB238’s sister bill, Senate Bill 220, is still alive but has not moved as quickly through the approval process. This bill would make $83M in transferable film tax credits available for the Nevada Studios project proposed at the Harry Reid Research and Technology Park. The bill is backed by Manhattan Beach Studios Group and Birtcher Development.

Applied Economics of Phoenix Report

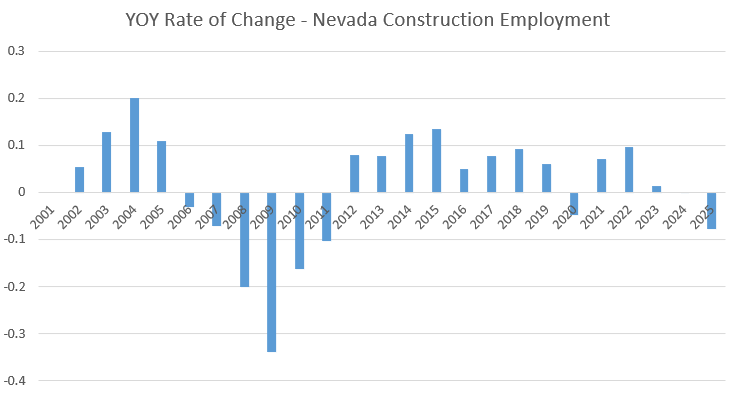

Applied Economics of Phoenix recently released two independent reports that cover the economic impact of both AB238 and SB220. On a macro-scale, the reports found that neither piece of legislation would be able to generate enough tax revenue to pay for itself.

While the reports stipulate the projects would both directly and indirectly spur economic growth, they claim it will have a modest impact on state revenue.

Notably, SB220 claimed Nevada Studios will generate $1.36 for every $1 of tax credits across its 18-year lifespan. The report, however, found the studios will only be able to generate 35 cents for every $1.

The report also found Summerlin Studios will generate around 52 cents for every $1 spent in film tax credits. This is much closer to the results found by project proponents. The report found the State of Nevada will receive $0.23 for every $1.

SB220’s sponsor, Roberta Lange, defended the bill by saying it was being introduced to diversify Nevada’s economy and create a “next-generation economic base.” She also claimed the variations in the evaluation of the studio were due to the use of other economic forecast systems and modeling differences.