The 120-day legislative session ended on Monday, June 2. Neither of the film tax credit bills were passed; however, Assembly Bill 540, the attainable housing bill, slid through.

Film Tax Credit Bills

This legislative session saw two film tax credit bills, Senate Bill 220 and Assembly Bill 238. If the bills had been approved, it would have resulted in more than $1B being set aside to offer tax breaks for filmmakers to support the development of studios.

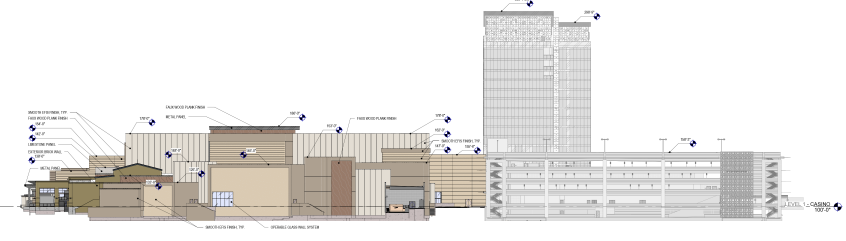

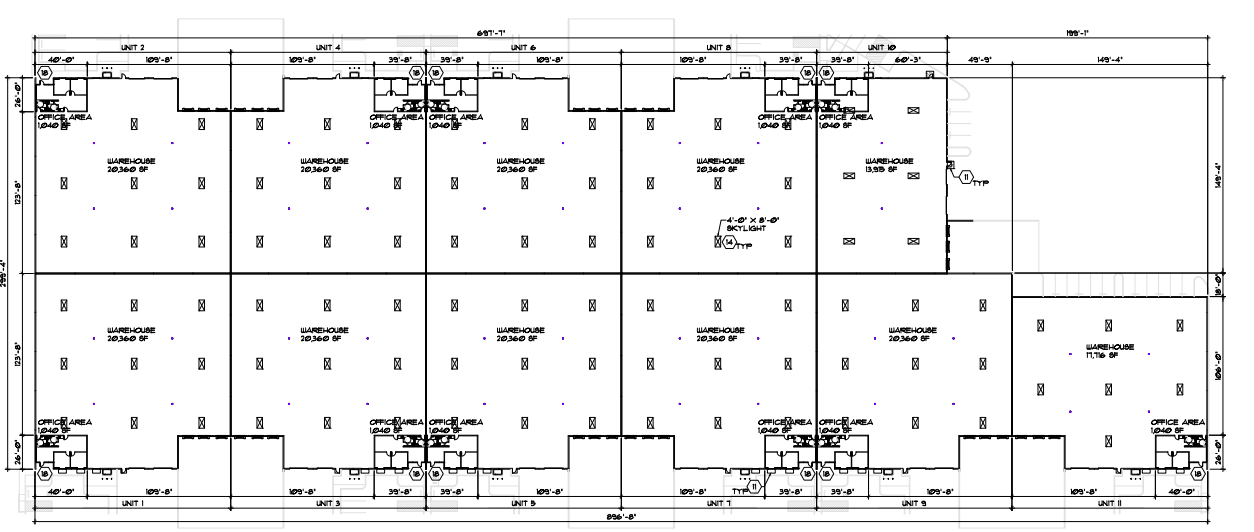

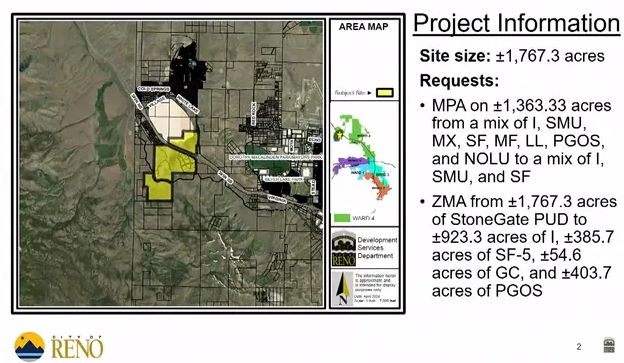

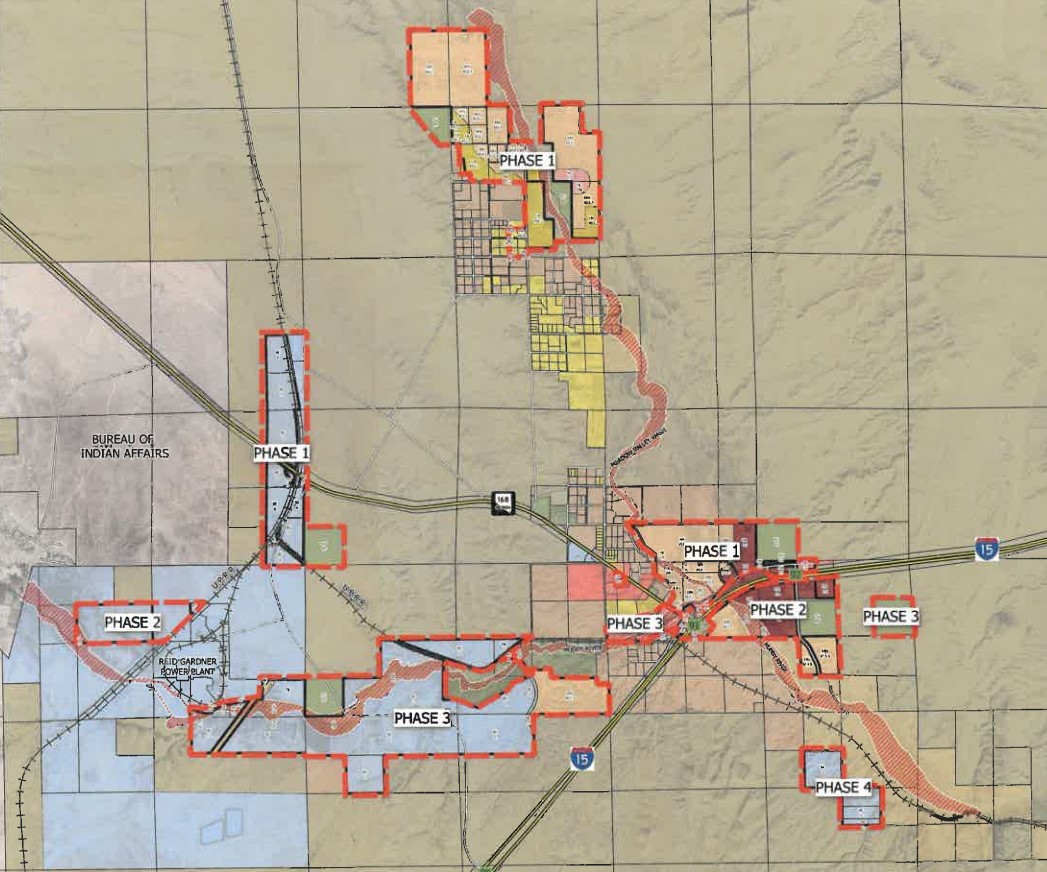

If AB238 had passed, it would have brought about a studio developed by Sony Pictures Entertainment, Warner Bros. Discovery and Howard Hughes Corp. called Summerlin Studios. SB220, on the other hand, would have provided for the Nevada Studios project at the Harry Reid Research and Technology Park. This studio would have been developed by Manhattan Beach Studios Group and Birtcher Development.

NVBEX extensively covered the proposed film tax credit legislation. (NVBEX; Jan. 14; Feb. 15; Feb. 28; May 31; June 5)

In an effort to save the legislation, a last-minute amendment was proposed that would instead turn the development into a study. The bills did not end up receiving a vote, as Republican state senators held up the final minutes of the legislation, saying they had unequal representation in the legislative commission.

Republicans also called for procedural recounts and talked for an additional 10 minutes until the clock struck midnight. They then argued it would be unconstitutional to continue with business and that the legislative session had concluded.

While lawmakers were unable to discuss the film tax credit legislation, the proposed amendment to alter the tax credits to a study suggests it likely would have failed if a vote were to be taken. Notably, Democratic leaders situated the bill at the bottom of the agenda. AB238, which had moved farther than SB220, barely passed the Assembly with a 22-20 vote.

Gov. Lombardo’s Housing Bill

Gov. Joe Lombardo’s proposed Assembly Bill 540 ultimately passed with an amendment proposed by Sen. Edgar Flores, D-Las Vegas.

AB540 was centered around a $133M attainable housing fund to support more affordable housing developments. Flores’ amendment added an additional $50M “tier one affordable housing” fund for households that have a gross income of less than 30% of the Area Median Income. The $50M will be funded via bonds.

Lombardo’s original proposal would have created a $250M budget that was intended to provide homes for up to 16,000 households. The revised $133M budget was estimated to be able to assist around 5,000 households. (NVBEX; June 4)

The legislation also extends the definition of affordable housing to include people who make up to 150% of the AMI. Attainable housing developments are also to have an expedited process to streamline pre-construction process.

Another amendment was proposed to set a limit on how many residential units businesses can purchase annually. The proposed limit was 2,000 units, but the amendment was ultimately dropped.