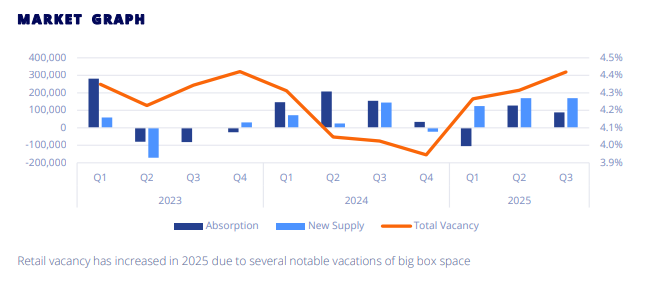

The Southern Nevada Retail market demonstrated an increase in vacancies and asking rates, while it absorbed less than in other recent periods.

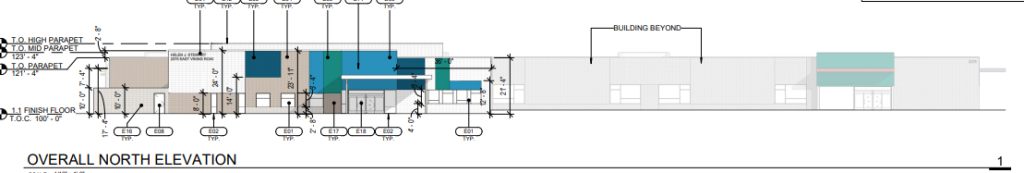

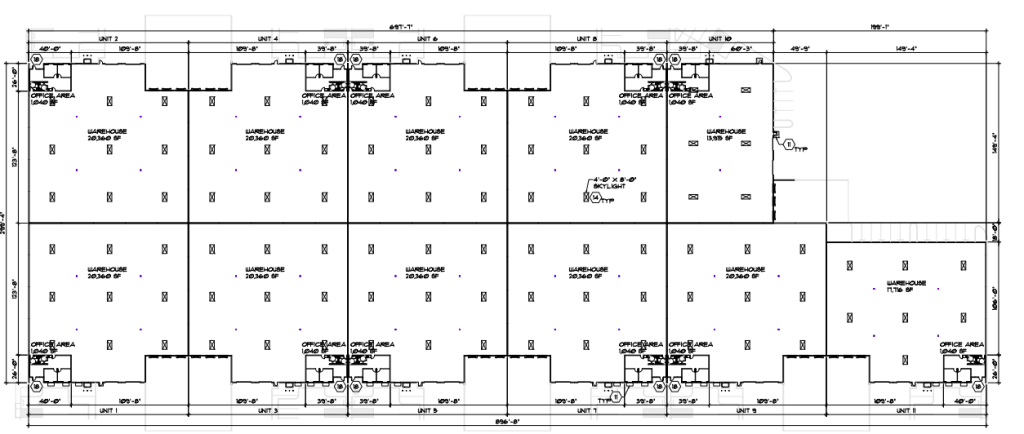

Q3 2025 saw 169.1KSF of completions in the sector, according to a report from Colliers. The majority of retail completions in the quarter were the new Costco in the Southwest submarket.

Additionally, there is nearly 306KSF in Retail space planned within the next four quarters. Of the planned space, 63.2% is pre-leased.

Absorption

The quarter reflected a net absorption of 87.8KSF, which is a decrease both quarter-over-quarter and year-over-year. Community centers had the highest total of net absorption at 251.9KSF, while freestanding Retail had a significantly smaller positive net absorption at 174SF. The remaining subtypes all had negative net absorption.

Positive absorption was seen in the Southwest, Downtown and University East submarkets. Negative net absorption was demonstrated in the Henderson, North Las Vegas and West Central submarkets.

Vacancy/Rents

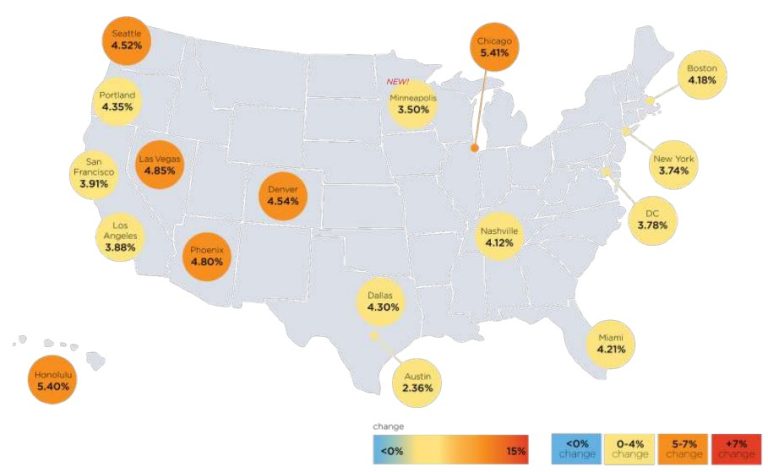

Q3 had a vacancy rate of 4.4%, which is 0.1 point higher QoQ and 0.4 points higher YoY. Neighborhood centers demonstrated the highest vacancy rate at 5.4%, while freestanding retail only had a vacancy rate of 2.3%.

The largest vacancies were seen in the Downtown, Henderson and University East submarkets. More specifically, Downtown had the highest vacancy rate at 7.1%.

The average asking rental rate increased this quarter. The average was reported as $1.88/SF NNN. In terms of YoY data, this is a $0.17/SF increase. Henderson boasted the highest asking price at $2.87/SF NNN.

Outlook

As vacancies have continued to rise across most sectors in the region, Retail has remained relatively strong. The 4.4% average vacancy rate is on the lower side, and the rising asking rental rates show demand is still present.

In collective terms, Q1 had a significant negative net absorption, as a plethora of big-box stores closed around the nation. This can be seen as somewhat of an outlier, but its effects on the region have been palpable.

The negative net absorption in Q1 eliminated a large portion of the growth seen in 2024. The region is beginning to rebound as Q2 and Q3 combined for 215KSF of net absorption, which has ultimately turned the year positive.

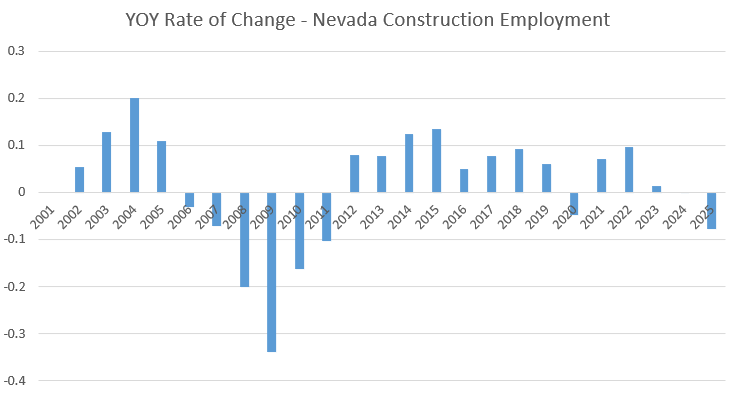

Employment and taxable sales growth have continued to trend negatively, which has the potential for negative effects in Q4.

To see Colliers’ report, click here.