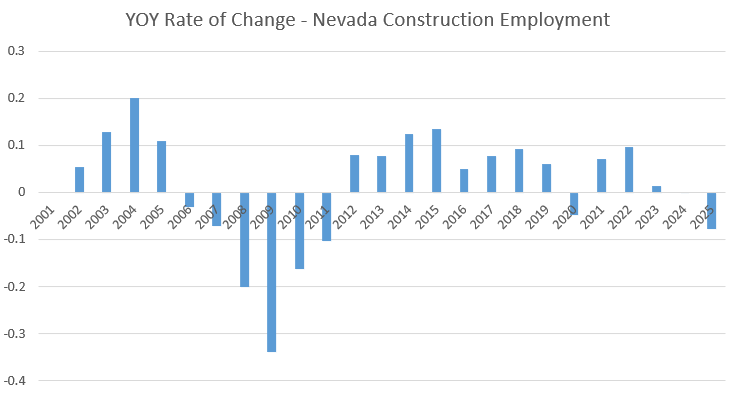

Employment in Nevada’s Construction sector experienced a steep decline in June.

In terms of seasonally adjusted data, Nevada lost 1,500 month-over-month positions. The current total Construction employment count is at 106,600, which reflects a 1.4% decrease MoM. Notably, total Construction employment in May was adjusted to 108,100.

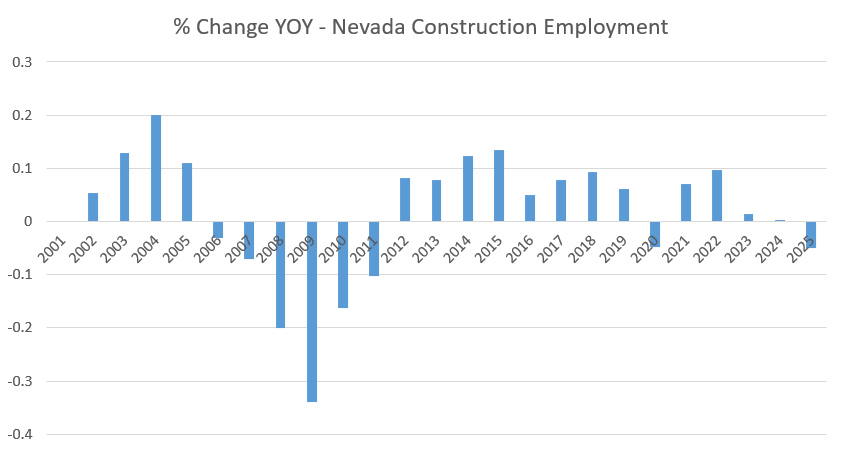

The sector now sits at 6.8% of the total nonfarm employment in the Silver State, according to nevadaworkforce.com. In terms of year-over-year data, Construction employment has fallen by 3,900 positions, which accounts for a total decrease of 3.5%.

December of 2024 had a grand total of 112,300 Construction jobs. This means that over the first half of 2025, the sector shed 5,700 positions, which is a 5.1% dip.

On a larger scale, Construction experienced the second largest decrease in employment over the month, trailing behind Government, which lost 4,100 jobs. The other three sectors to lose positions were Other Services, which lost 600, Trade, Transportation and Utilities, and Manufacturing, which each declined by 300.

The largest Construction employment total to end the year was 142,200 in 2005. The total continued to rise to 146,400 in April of 2006 but fell to 137,700 by the end of the year.

EDITOR’S NOTE: We are including both seasonally and non-seasonally adjusted data. Seasonally adjusted data continues to change after it is originally posted; so the wider array of data is intended to provide a more accurate view of the market.

Non-Seasonally Adjusted Construction Data

Non-seasonally adjusted data showed Construction at 108,500 jobs at the end of June. This reflects a much smaller dip than seasonally adjusted data, as reports indicate the sector only fell by 500 positions, or 0.5%. In YoY terms, the sector has still experienced a rather large loss, with reports indicating a decline of 3,300 positions, or 3%.

Non-seasonally adjusted data splits Construction into two subcategories: Construction of Buildings and Specialty Trade Contractors.

Despite both subsectors losing a similar number of positions, 300 for Construction of Buildings and 200 for Specialty Trade Contractors, it dealt a heavier blow to the former. Construction of Buildings is a much smaller subsector than Specialty Trade Contractors, only boasting 18,000 positions compared to the latter’s 79,600.

Construction of Buildings currently makes up 1.1% of the total nonfarm employment in the state. At the subsector’s peak, it totaled 26,500 jobs.

The loss of 200 positions represents 1.1% of the subsector’s total employment. In terms of YoY data, however, Construction of Buildings is performing much better. The subsector has only lost 100 jobs, which is 0.6% of its total employment.

Specialty Trade Contractor’s decline of 300 roles has put it at 79,600 total jobs, which only demonstrates a loss of 0.4% MoM. YoY, the subsector has now lost 2,600 positions, which accounts for a 3.2% dip.

Credit: BEX Using nevadaworkforce.com Data Points

Currently, the subsector accounts for 5.1% of total nonfarm employment. It had 107,200 positions at its peak.

Seasonally Adjusted Non-Construction Fields

The closely related Manufacturingsector fell by 300 jobs MoM to its new total: 67,200. Interestingly, the initial report from May pegged the sector at 67,600 positions, meaning it has since been adjusted to 67,500.

The sector is still near its all-time high of 67,700 jobs. In terms of YoY data, the sector as a whole has gained 600 positions, which accounts for a growth of 0.9%.

Most of the growth has been demonstrated in Manufacturing’s Durable Goods subsector, which has gained a total of 1,400 YoY jobs. This reflects a growth rate of 3.2%. MoM, Durable Goods only lost 100 positions, or 0.2%. The subsector currently makes up for 2.9% of total nonfarm employment.

Nondurable Goods, Manufacturing’s other subsector,lost 200 MoM jobs, which is 0.9%. The subsector currently totals 21,800 positions. YoY, the subsector has dipped by 800 roles, or 3.5%.

June demonstrated a higher total of losses than gains across all sectors, as Professional and Business Services was the fastest-growing sector in terms of both raw data and percentage growth. The sector gained a total of 900 positions. This is the third largest nonfarm sector in the Silver State, representing 13.9% of its overall employment.

The sector’s 900-job increase represents a growth rate of 0.4%. The grand total employment count of the sector is currently pegged at 219,300.

The uncontested giant in Nevada, Leisure and Hospitality, remained mostly flat over the month, only growing by 300 positions in its Arts, Entertainment and Recreation subsector. The sector as a whole represents 23.4% of nonfarm employment and peaked at 369,300 jobs. Currently, it stands at 367,600 positions.