A U.S. Bankruptcy Court hearing for Reno Kimpton hotelin Reno was held on May 14.

The lawsuit includes the parties CAI Reno Hotel Partners LLC, a subsidiary of CAI Investments, and Court Street Ventures LLC, which is related to Davidson Group.

Reno Kimpton held a ceremonial groundbreaking in 2022 with an opening date originally scheduled for 2025, but construction activity never took place. Instead, the project proceeded to run into a series of delays, as well as a separate lawsuit surrounding an old sewer line. A notice of default was later filed in July 2024 over the $11.3M loan. The Reno Kimpton project proceeded to file for Chapter 11 bankruptcy protection prior to a foreclosure sale scheduled for Oct. 30, 2024.

Project Details

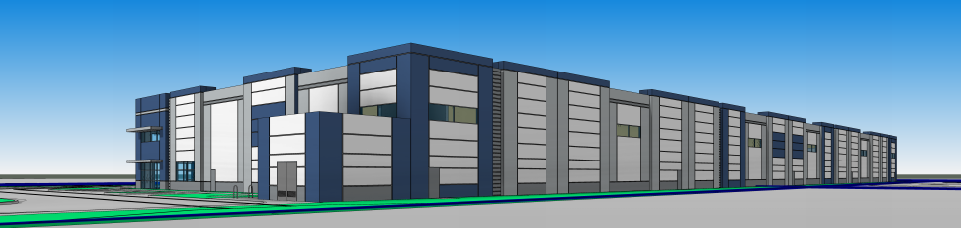

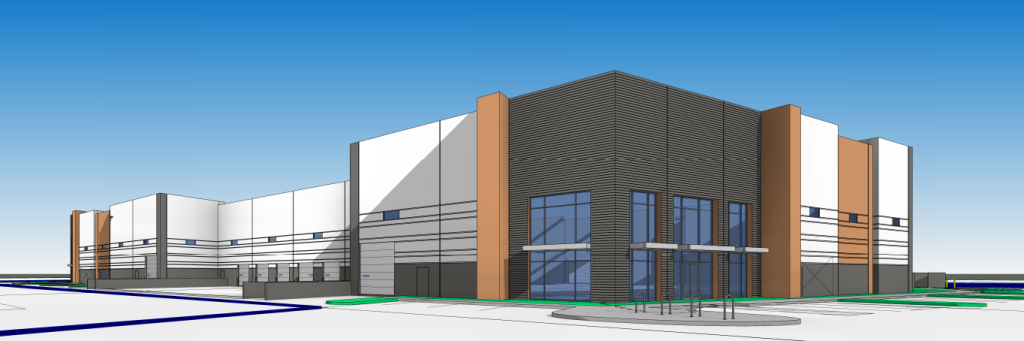

The proposed mixed-use hotel would be 20 stories tall and be constructed near the riverwalk downtown. The hotel would feature 270 rooms. The development was also set to include 50 condominium units, 60KSF of office space and 20KSF of meeting space.

The Kimpton-branded hotel site is owned and under development by CAI Reno Hotel Partners. Obermeier Sheykhet Architecture is the architect.

Court Street Ventures is arguing for the Chapter 11 bankruptcy to be either dismissed or changed to a Chapter Seven bankruptcy. Chapter 11 bankruptcy gives CAI the opportunity to continue operations and reorganize its finances while figuring out how to pay off its accrued debts. Chapter Seven bankruptcy, however, would liquidate CAI’s assets to expedite payments.

Court Street Ventures has been granted relief from the stay of the project’s Chapter 11 filing. This allows Court Street to take legal action against its debtor. Furthermore, the lender is permitted to list the project for a trustee or foreclosure sale.

Project Value and Viability

CAI and Court Street Ventures are essentially arguing about the viability of the development. CAI claims it is not at fault for the hurdles that have plagued the project and that they have all been circumstantial. Specifically, the developer pointed to aging city infrastructure and its ongoing legal battle with a neighbor.

CAI has stated it firmly believes the project will be able to be completed and bankruptcy will give it the time and breathing room to make that happen. CAI went on to say the protections provided by Chapter 11 bankruptcy are vital for the lifeline of the development. CAI also claimed Court Street moved the foreclosure sale from June 20 to May 16.

The developers reached out to project investors on April 17 in an attempt to raise enough money to pay off Court Street Ventures’ loan. CAI was unable to raise enough funds.

Developers then turned to the courts and argued the value of the collateral is substantially more than what it owes the lenders. For evidence, CAI pointed to an appraisal completed by Keith Harper that indicates the parcels are worth at least $19.59M.

Court Street Ventures argued the appraisal was dubious and did not factor in several concerns that would lower its price tag. The lenders believe the appraisal was overvalued and should not be used.

CAI said Court Street Ventures does not have any evidence to suggest the parcels are worth any less.

Court Street Ventures is also arguing the project is both undersecured and has been subject to mismanagement.